Admin

Blog Summary

Exploring market intelligence as an indispensable tool for all business sizes, this blog debunks the myth that it's only for industry giants, illustrating its critical role in navigating the fast-evolving market landscape.

Key Points Overview

Top Takeaways

Conclusion

Embracing market intelligence transforms data into actionable insights, empowering businesses to not just survive but thrive by staying one step ahead of market trends and consumer needs.

Market intelligence is how modern businesses stay ahead in fast-moving, noisy markets. If you’ve ever made a product decision too late, launched a campaign that didn’t land, or missed a competitor’s move until it was too late to respond, you already know the cost of operating without it.

Market intelligence provides a current, comprehensive understanding of what’s happening outside your organization—across customers, competitors, and the broader market landscape. It goes beyond static reports, delivering timely insights that support faster, better decision-making.

The truth is that market intelligence – the basic awareness of the state of the market – is no longer optional for businesses of any size today. People’s buying and consuming habits have been in a constant shift in the last few years, and the changes are happening faster than ever before. And surging ecommerce as the preferred purchase method of consumers makes it easier than ever for new ideas to penetrate the market and break through traditional supply chains. That means that the competition is fiercer than ever – and that not every brand will survive these shifts.

What’s a company to do? The only way to survive in this highly competitive climate is to keep a constant finger on the pulse of the market and stay a few steps ahead of your competitors, and ahead of the developing trends. And this is market intelligence: having an unbiased 360-degree view of all data sources from all the systems and networks available to you and being able to separate the signal from the noise.

Simply put, market intelligence is the practice of gathering and analyzing all the data and information about the market that is relevant to your company to gain continuous insight into market trends, competitors, as well as customers’ values and preferences.

Market intelligence is the brand awareness created through capturing and monitoring information about products, trends, consumers, and competitors. It involves monitoring a wide variety of relevant sources across the web as well as integrating proprietary consumer resources to aggregate and analyze all data sets as a whole.

Learning how to conduct market research is indispensable as it can provide insight into trends, competitors, and the voice of the customer, as well as help prevent crises and efficiently guide the company’s decision-making process as it relates to product development and innovation, marketing campaigns, managing customer experience, and improving customer service.

At its core, market intelligence is about observing the world outside your organization in a structured, ongoing way. The most useful insights come from connecting multiple signals—things your customers are searching, saying, reviewing, and doing.

These are the key input sources:

Search behavior: Shows evolving interests and emerging demand signals.

Social and community channels: Surfaces frustrations, trends, and shifts in sentiment.

Customer reviews: Offers unfiltered insight into what’s working and what’s not.

News and media: Brings visibility into external forces shaping your market, like regulation or economic policy.

Competitor activity: Offers perspective into strategic moves like product launches, pricing shifts, or hiring patterns.

When analyzed together, these signals form a clearer picture of where the market is headed, where risks may lie, and where opportunities exist.

It’s easy to conflate market intelligence with traditional market research. While both are essential, they play different roles.

Market research is typically used to validate a hypothesis. It’s project-based, answering a specific question through structured methodologies like surveys or focus groups. Market intelligence, by contrast, is always on. It’s less about isolated answers and more about watching the whole ecosystem in motion.

Research tends to look inward and backward. Intelligence looks outward and forward.

What makes market intelligence so powerful isn’t just the data—it’s what it helps you do:

Act faster and with more confidence by responding to trends before they peak.

Improve product-market fit by aligning offerings to real customer needs.

Outmaneuver competitors by understanding their shifts in positioning or investment.

Minimize risk through earlier visibility into reputational issues, unmet needs, or shifting regulations.

Drive better ROI by focusing resources on what’s gaining traction, not what’s just been done.

According to Gartner, the main immediate benefits of conducting market research and industry analysis on the regular basis include “real-time descriptive, diagnostic and predictive analytics [that supply] prescriptive information about the best available action to be taken in response to the situation.” And organizations that use market intelligence continuously in a strategic way will see “improved situational awareness and a common operating picture across business functions by providing real-time dashboards, alerts and best-next-action recommendations, [as well asl] the capability to trigger automated responses by sending signals to machines or initiating business processes in cases where the decision on what to do can be automated.”

Market intelligence is the difference between playing catch-up and setting the pace.

Brand awareness keeps you informed on who is talking about your brand and what they are saying. Keeping a constant finger on the pulse of brand health over time reveals what your normal is and sends your spidey sense tingling when things are about to go south.

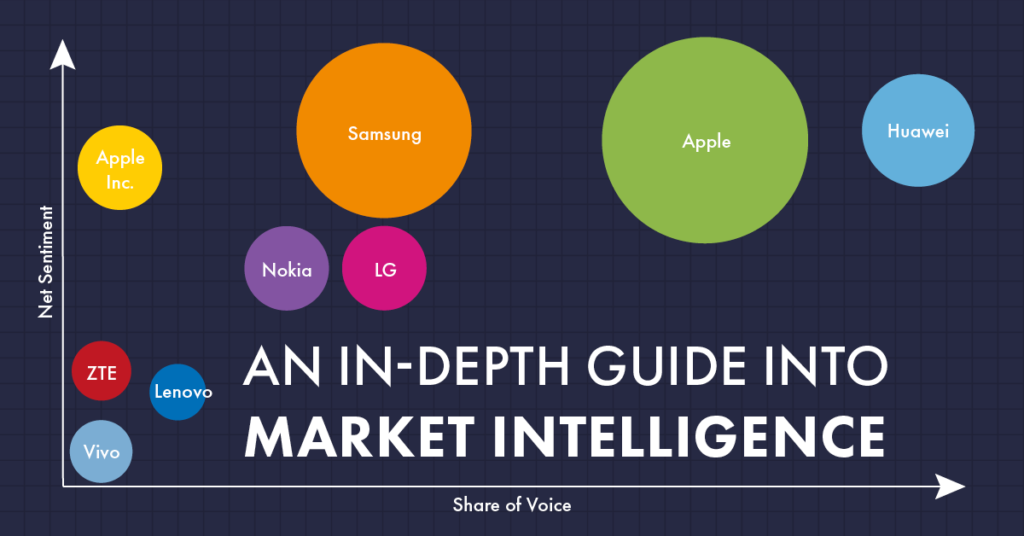

Competitive intelligence is the systematic collection and analysis of any information related to your competitors in an effort to understand what is happening in your industry and where you stand in relation to them. It informs your own marketing to better capture the attention of consumers and to take advantage of gaps in the market before they become apparent to everyone.

The company's dataset captures company and investment information and is a good first step to start monitoring competitors’ health.

Another important component of market intelligence is consumer intelligence, the practice of gathering all possible information from a variety of data sources as it relates to your consumers – past, future, and prospective. 32% of consumers report that they’d walk away from a brand they love after just one bad experience. Consistently monitoring how your consumers experience your brand and listening to the voice of the customer will help you prevent customer churn, improve customer service and build relationships with them.

The third important component of market intelligence is product intelligence. This is where you analyze your product or service and monitor the conversations around it to better understand how it measures against similar offerings in the market. Armed with this intel, your brand has the agility to push identify market gaps and pivot quickly when necessary.

And product intelligence includes information about the various market factors related to its product and supply. For instance, if your textile company is heavily dependent on bamboo sheets, you want to be aware of potential supply disruptions in the bamboo industry. Product intelligence tell you that.

Trend analysis should be the backdrop of all the other components. Understanding emerging trends and monitoring existing trends for growth or decreasing interest can make or break a business. A thorough consumer trend analysis means keeping tabs on both traditional media and performing regular social media analysis, allowing your brand to better align itself with the changing tides.

You don’t need to start with a massive investment. What matters most is intention and consistency. Begin with a few clear questions that decision-makers care about: What are our customers starting to care about that we aren’t addressing? What gaps are our competitors leaving wide open?

From there, define what signals to monitor. Who will collect and analyze them? What cadence will you review findings and take action? Who needs to see this?

The most effective organizations make intelligence part of the rhythm of decision-making—not a side project. That means integrating intelligence into product planning, campaign development, category strategy, and even quarterly business reviews.

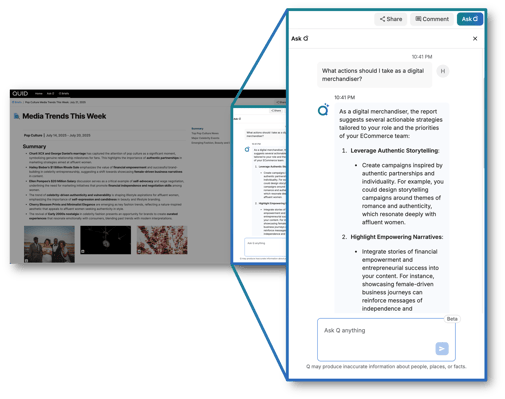

Leading brands and agencies use market intelligence before launching a campaign to understand relevant conversation and sentiment. After all, studies show that consumers are more likely to purchase from brands whose values align with theirs, so social sentiment analysis should be an essential part of any market intelligence strategy.

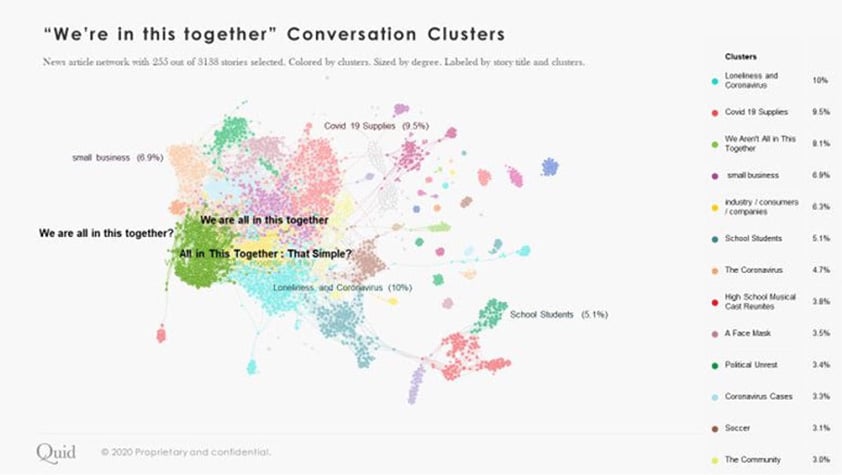

For instance, during the pandemic, many brands created ads that sought to represent the consumer voice on the exhausting impact of these events. They wanted to openly recognize the challenges of the new normal, and offer hope.

How did the brands manage to find the right tone for their message? With social listening, or the data collection and analysis of what your target market is talking about, and how phrases such as “we’re in this together” were performing on social media. With campaigns specifically centered around current events, it is crucial to understand the collective sentiment of consumers, and your target market in particular, to develop the right tone and messaging.

Market intelligence isn’t limited to one function or vertical. Its applications are wide-ranging:

Retail & CPG: Identify rising ingredients, packaging preferences, or consumer values before competitors do. Use this to inform assortment, pricing, or campaign timing.

Healthcare & Pharma: Understand patient sentiment, monitor competitive trials, or anticipate shifts in regulatory guidance.

Tech & SaaS: Track adoption of new APIs, feature expectations, or pain points being surfaced in developer forums.

Financial Services: Monitor regulatory language, investor sentiment, or emerging fintech competitors to de-risk strategic moves.

In each case, the value lies not in the data itself, but in knowing when and how to move.

For market intelligence to be treated as a strategic investment, it needs to show measurable value. While its impact may not always be immediate, it consistently influences business performance when embedded into decision-making processes.

Start by evaluating how intelligence is improving your organization’s responsiveness. Are your teams acting on insights more quickly than before? A reduction in the time between identifying a market opportunity and executing on it is a strong early sign of ROI. Equally important is whether intelligence is actually being used—are key stakeholders referencing this data in planning meetings or strategy reviews?

You’ll also want to assess downstream impact. If product decisions informed by intelligence lead to higher adoption rates or stronger market fit, that’s a direct link to revenue. On the flip side, if intelligence helped you avoid a costly launch or pivot away from a poorly aligned campaign, that’s cost savings you can quantify.

Here are a few key indicators to watch:

Speed to insight: Measure how much faster your teams are identifying and responding to new market signals.

Insight adoption: Track whether different business units are incorporating intelligence into their strategies and actions.

Revenue impact: Attribute performance improvements—like higher conversion rates or improved customer retention—to intelligence-led decisions.

Cost avoidance: Identify investments that were paused or redirected due to risk or lack of opportunity surfaced by intelligence.

Time saved: Estimate reductions in time spent manually gathering or validating information across teams.

The goal isn’t just to collect data—it’s to build a system that consistently drives smarter, more confident business moves. When intelligence shortens cycles, improves bets, and reduces missteps, it’s delivering ROI.

With so many platforms claiming to offer market intelligence, it’s important to separate those that deliver actual decision-making value from those that merely organize data. A good market intelligence tool should do more than track mentions or count keywords. It should help your team understand patterns, uncover emerging themes, and connect those insights to your business context.

Start by looking at the range of data sources the tool can access. If it only scrapes a few social channels or relies on dated information, you’ll miss critical signals. Look for tools that integrate multiple data types—social, search, reviews, news, competitor signals—so you’re not making decisions based on a partial view.

Speed matters too. A platform that updates monthly won’t help you react to a trend that’s gaining momentum right now. Real-time or near real-time capabilities ensure you’re seeing shifts as they happen, not after the opportunity has passed.

Just as important is the tool’s ability to frame insights in your business language. Tools that allow for customization—by category, product, customer segment, or business goal—make the output more relevant and actionable. The best platforms deliver insights in formats that plug directly into your workflow, from dashboards for execs to detailed reports for analysts.

Here’s what to consider when evaluating a tool:

Breadth of sources: Does it cover all the signals that matter to your market and customer base?

Real-time access: Can you detect change as it happens, or are you always playing catch-up?

Customization and context: Can the tool be tailored to your business objectives and language?

Usability and integration: Will your team actually use it? Does it integrate with tools you already rely on?

Support and scalability: Is there guidance to extract full value? Will the platform grow with your needs?

Quid’s market intelligence solution is built with these needs in mind. It brings together diverse data sources, domain-specific AI models, and a focus on decision outcomes—not just dashboards—so your team doesn’t just see what’s happening, but knows what to do next. Reach out for a demo today!