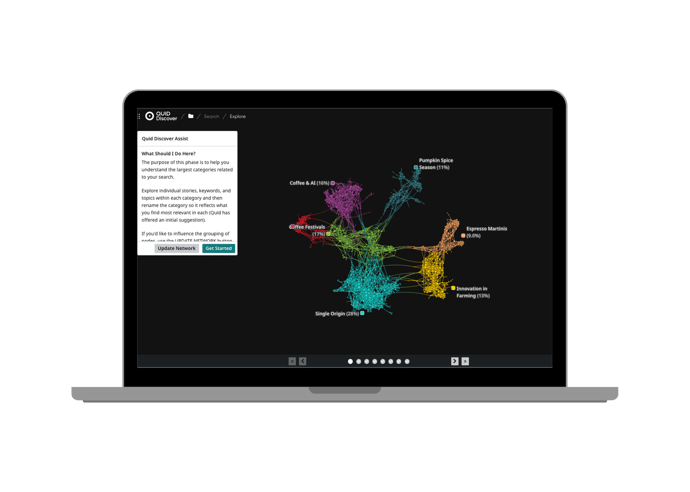

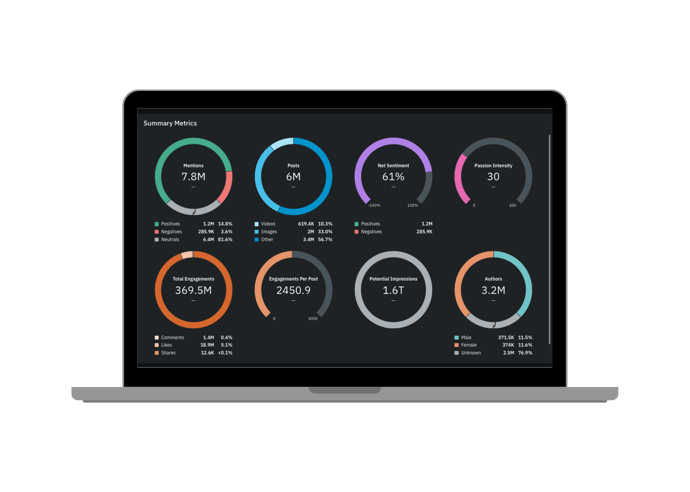

Quid streamlines insights across your organization, enabling a unified, data-driven strategy that transcends departmental boundaries.

With real-time consumer and market data delivered directly to your business intelligence systems, your stakeholders can make smarter decisions by looking at consumer and market data alongside sales, marketing and other business-critical data points.

Quid ensures that your BI Systems are continuously updated based on your needs, from raw data to custom metrics, and doing it without breaking the bank.

.png?width=690&height=493&name=Monitor%20(3).png)

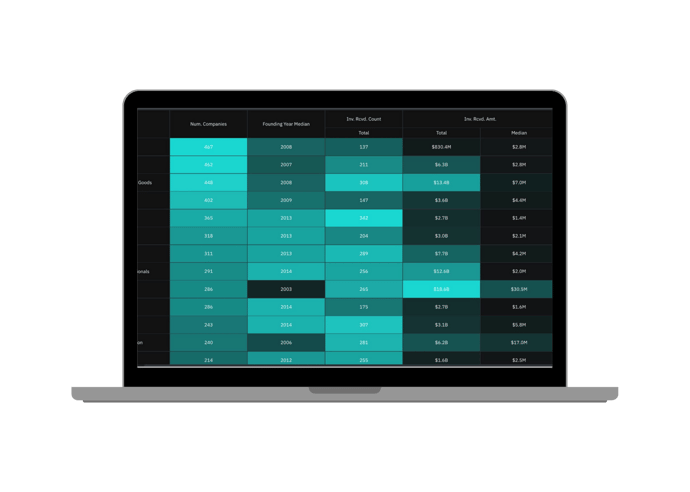

Quid provides cleansed data from industry-leading sources enabling you to trust the data behind your decisions.

Quid supports deployment the way your business requires it, leveraging your existing BI systems, and giving you the option to use your own data science models without needing to leverage specialty tools to access consumer and marketing data.

For in-depth research, e-books, thought leadership articles, and product sheets, turn to us for everything you need to enhance your consumer and market intelligence knowledge.

Discover how the kidult economy is transforming retail through nostalgia, emotional attachment, and scarcity, driving sustained demand and community engagement.

2/26/26

Discover how the 2026 Oscars conversation is shaping up with insights on trends, demographics, and thematic clusters driving early engagement.

2/19/26

Super Bowl LX showcased that the real impact lies in multi-platform narratives and cultural engagement, rather than just the game or ads themselves. Discover how brands thrived in this new ecosystem.

2/12/26