Quid simplifies the journey to data-centric decisions, equipping your team to anticipate market shifts, elevate customer experiences, and foster enduring brand loyalty.

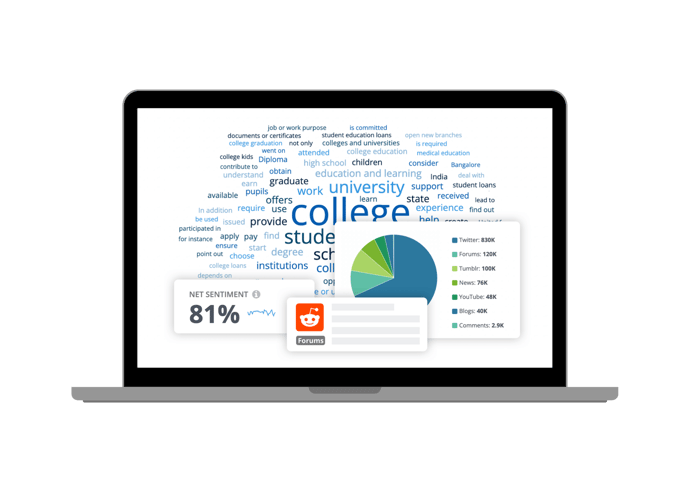

Quid delivers real-time customer intelligence, offering insights into conversations about your brand and products across key consumer discussion channels.

Quid's advanced text analytics and sentiment analysis translates the meaning behind customer feedback.

Understand sentiments, mood shifts, and customer context at a granular level.

With Quid, make sure every team and stakeholder taps into the pulse of customer conversations. Elevate collaboration and ensure a unified strategy with shared access to data and insights.

.png?width=2000&height=1428&name=Predict%20(2).png)

With Quid's timely data insights and forward-looking trend analysis, empower your teams to make proactive decisions, pivot according to market shifts, and always have an edge over the competition.

Leverage Quid to fine-tune your messaging, campaigns, and customer interactions. By diving deep into your competitors' strengths and areas for growth, you'll always be a step ahead of the game.

For in-depth research, e-books, thought leadership articles, and product sheets, turn to us for everything you need to enhance your consumer and market intelligence knowledge.

Discover how the kidult economy is transforming retail through nostalgia, emotional attachment, and scarcity, driving sustained demand and community engagement.

2/26/26

Quid Expands Its AI Ecosystem with Enterprise Integrations via MCP, Slack and Microsoft Teams and The Industry’s Largest Library of AI Agents

2/26/26

Discover how the 2026 Oscars conversation is shaping up with insights on trends, demographics, and thematic clusters driving early engagement.

2/19/26