Showcase your agency's expertise by swiftly crafting data-driven pitches that showcase an in-depth understanding of your client's business, market dynamics, competition, and marketing strategies.

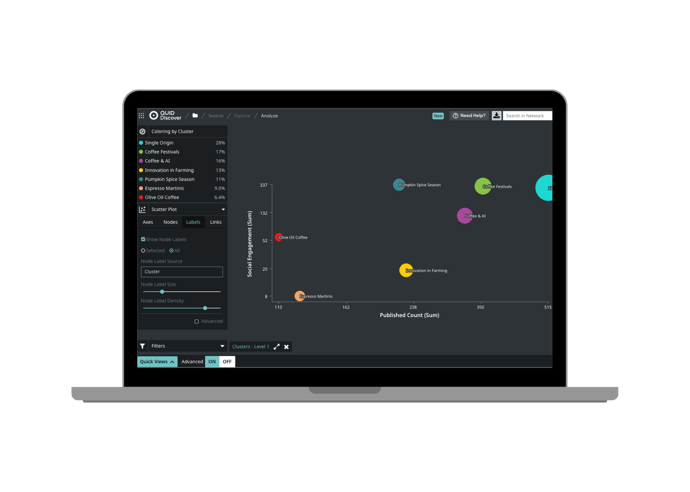

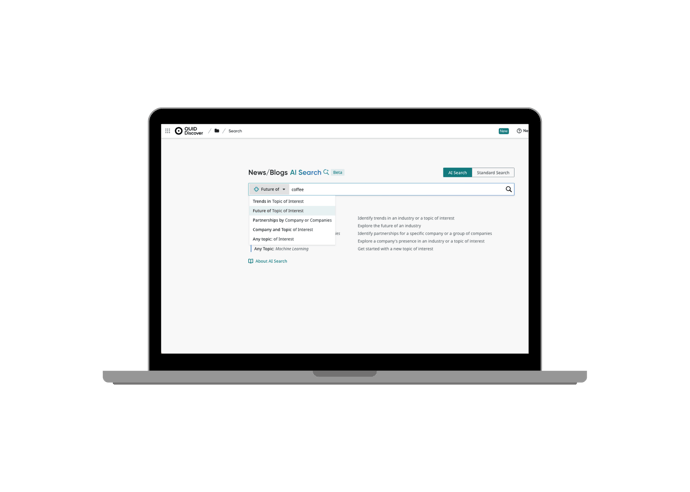

Empower your agency's uniqueness to craft winning RFPs and pitches that set you apart from the competition. Design tailored applications with Quid's predictive capabilities, rich data, and insightful analysis.

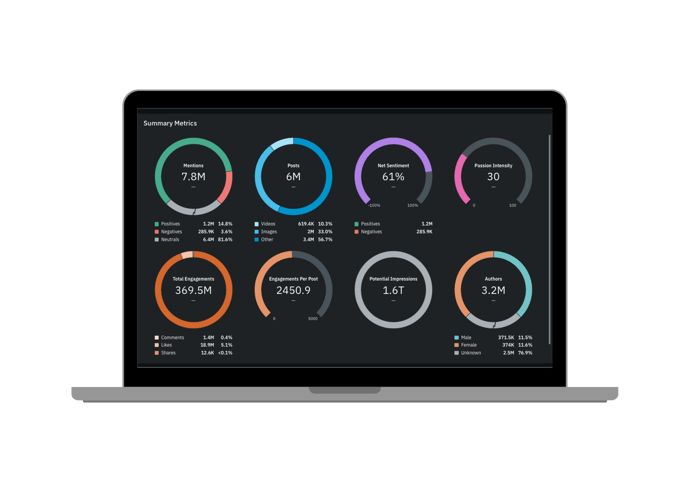

Lean on Quid for meticulously curated data from top-tier industry sources, ensuring your analysis always stands on solid ground.

Rather than adopting a one-size-fits-all approach, we champion partnerships rooted in genuine understanding, active collaboration, and a shared commitment to achieving mutual success.

Dive deep with Quid's seasoned AI expertise, streamlining your insights journey and amplifying the return on your intelligence investments.

For in-depth research, e-books, thought leadership articles, and product sheets, turn to us for everything you need to enhance your consumer and market intelligence knowledge.

Discover how spring cleaning has evolved into a year-round behavior driven by micro-routines, social media, and consumer habits.

3/6/26

This year, the benchmark report is bigger and broader than ever, spanning over 18 industries including Alcohol, Automotive, Aviation, Beauty, Energy, Fashion, Financial Services, Food, Higher Education, Hotels & Resorts, Influencers, Media, Nonprofits, Pets, Pharma, Retail, Sports, and Tech. And for the first time, we’re introducing YouTube metrics alongside Facebook, Instagram, TikTok, and X.

3/5/26

Discover how the kidult economy is transforming retail through nostalgia, emotional attachment, and scarcity, driving sustained demand and community engagement.

2/26/26