Brands will be dealing with a savvier, more informed audience. Looking to make smart purchases both for their wallets’ sake and their self-investment.

A dominant narratives centers on verifying the authenticity of discounts, with consumers across social platforms strategizing purchases, debating whether to buy now or hold out for deeper discounts, and sharing intel on historic price drops.

Especially for technology, gaming, fashion, and home goods, audiences are benchmarking upcoming deals against previous years, with users tracking historic lows and using tools such as camelcamelcamel to verify that Black Friday offers represent genuine value rather than inflated discounts.

This conversation is not just about seeking discounts but ensuring real value, with users reluctant to buy until they confirm deals are genuinely better than recent trends.

‘I track prices and some of the stuff is just not that good of a deal, even for Black Friday… camelcamelcamel helps.’ reddit.com

‘A good price history tracker like camelcamelcamel is essential for Black Friday.’ reddit.com

‘I don’t feel like these so-called Black Friday deals are really all that better than what’s been out there for weeks.’ reddit.com

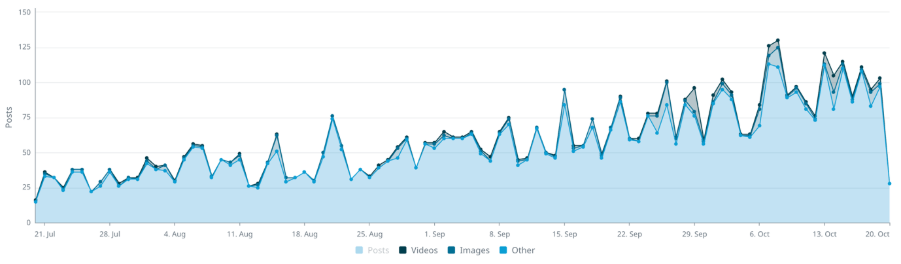

In the past three months over 5% of conversations discussing Black Friday and Cyber Monday focused on comparisons of last year’s pricing, and tracking. And as seen below this is growing in volume.

There is also robust dialogue around the trend of early Black Friday and Cyber Monday sales, with mentions of “pre-Black Friday” and “early access” events.

While some shoppers appreciate the extended sale periods, others voice frustration over promotional fatigue and concerns about missing out on the best offers by purchasing too soon.

This narrative is less about specific items and more about timing and deal optimization, with users swapping tips on when actual “best deals” are likely to drop.

In addition to getting savvy with pricing, consumers are getting organised and focused, with many conversations focusing on personal wish lists and strategic purchase planning.

Shoppers are publicizing specific items they hope to score—like electronics, gaming consoles, PC parts, and designer goods. Lists are keenly curated in anticipation of standout deals, with some participants debating whether to act during early promotions or hold out for the main event. There is also collaborative sharing of wish lists and “what’s in your cart for Black Friday?” discussions, fostering a collective sense of preparation.

‘My wishlist is loaded with games in case they drop to all-time lows for Black Friday.’ reddit.com

I’m holding off on buying these PC parts until Black Friday, hoping for a steep discount.’ reddit.com

For Electronics; shoppers are primarily eyeing gaming consoles, PC components, laptops, monitors, and routers. Popular brands under discussion include PlayStation, Xbox, Nintendo, Asus, and TP-Link.

For Fashion; sneakers, and apparel are highly present in the chatter, with users building Black Friday wish lists around popular items like high-demand sneakers and designer clothing. While brand conversation is broad, there is particular focus on trending footwear and athleisure, though specific brand mentions occur less frequently compared to electronics.

For Gaming; deals are a core focus, not just hardware but also digital game sales. Gamers are listing anticipated titles and searching for historical lows, with marketplaces like Steam frequently cited. PlayStation, Xbox, and Nintendo are commonly referenced for consoles, while the discussion around games spans both AAA and indie releases.

For home and kitchen appliances; discussions around cookware sets, vacuum cleaners, and coffee makers, feature more in queries about whether Black Friday or Cyber Monday is the better time to buy. Specific product mentions appear, but fewer direct brand references are made compared to tech and gaming.

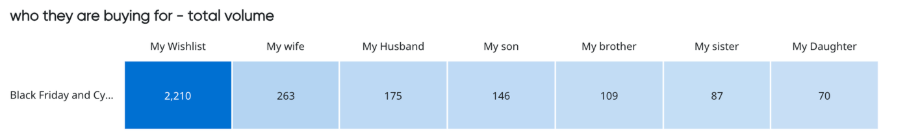

The overwhelming narrative in Black Friday and Cyber Monday discussions is self-purchasing.

Most users are focused on personal wish lists, optimizing their own tech setups, wardrobes, and gaming collections, and timing purchases to achieve all-time low prices for themselves.

Conversations revolve around “my wishlist,” “my cart,” and anticipating deals for items users have been tracking throughout the year. There is little organic mention of gift-buying as a primary motivation, reinforcing that Black Friday and Cyber Monday are perceived less as gifting events and more as an opportunity for strategic self-investment.

In a nutshell, it seems that to succeed this year brands have their work cut out for them and are more under pressure to meet high expectations.

Black Friday and Cyber Monday have become less about impulse buying and more focused on value, timing, and strategic shopping.

Brands would do well to think about publishing more educational content on how to identify authentic deals to build trust and should consider highlighting historic price comparisons in marketing materials to reinforce the legitimacy of offers.

Researched focused on: Past Three months (from 20th October 2025). Global English only analysis. Looking at Social Media, Blogs, Forums (incl. reddit), with a Personalnarrative filter.