Laurie P.

Introduction to the Blog Summary

This blog highlights the critical importance of consumer insights for brands, emphasizing how actionable data derived from social listening and analytics can enhance customer understanding and agility.

Key Points Overview

Top Takeaways

Conclusion

Harnessing consumer insights transforms how brands engage with their audience, leading to more informed decisions, better customer experiences, and increased competitive advantage in the market.

Brands must have a comprehensive understanding of their buyer personas and understand customer behavior, which makes market research and consumer insights matter more now than ever. Companies can improve the time it takes to pivot with actionable customer insight from consumer intelligence–sourced from continuous social listening and data analytics.

Your brand is unique and full of moving parts—including a marketing and sales team running in various directions, each requiring specialized insight into the voice of the customer. And since consumer opinion and behaviors constantly change, how you reached your audience yesterday may not work today.

With COVID in our rearview mirror, customers are eager to move forward as they adapt to a new way of doing things. These pivots, however, have caused marketers to struggle with elements of marketing campaigns such as product placement and targeted messaging that don’t feel forced. And to have customer success, brands need powerful tools that help them become and remain agile.

You have a choice: spend countless hours chasing consumer insights or streamline the process with social, market, and consumer intelligence tools that handle the heavy lifting for you. In this guide, we’ll explore the critical importance of consumer insights, focusing on the following key areas:

Incorporating consumer insights into your market research unlocks a deeper understanding of your global audience, enabling you to craft targeted marketing strategies and empower your team to stay attuned to customer sentiment. By gaining a clearer picture of your customers and recognizing their unique preferences across geographic regions, you can leverage these actionable insights to drive meaningful results—like those illustrated in the statistics below, and beyond:

With that, let’s dive in and explore the dynamic world of consumer research and customer insights from every angle.

Consumer insights are customer-centric and tell you what people are talking about, where they’re talking, and how they feel about the topic at every part of their customer journey. Additionally, consumer insights take a deep dive into who is taking part in the discussion, effectively dissecting your target market and target audience for trending attributes, such as:

Brands that immerse themselves in social conversations and analyze their target consumers on a deeper level gain actionable insights that can elevate their strategies and provide a competitive edge in any market. In contrast, under-informed brands often rely on guesswork or mimic successful competitors, leaving them stuck in a reactive position. Following the leader may keep you in the game, but it won’t help you surpass the competition or uncover untapped audience opportunities.

The good news is you don’t have to. Top-tier social listening tools and data analytics identify areas for a more profound and better understanding of your audience and their customer journey and capture the discussions of interest to your brand using both qualitative and quantitative data. Artificial intelligence then uses natural language processing (NLP) to categorize the text for granular-level consumer insights. With the right toolset, social listening puts comprehensive consumer insights at your fingertips. The only thing your tools won’t do is make business decisions for you.

Why are consumer insights so important? They enable brands to validate their business strategies and marketing ideas, supporting confident and effective decision-making. By leveraging consumer insights, companies can gain a comprehensive understanding of their customers, evaluate market demand, assess their impact along the customer journey, and compare their performance to competitors. Insights such as trending topics, demographic breakdowns, and customer sentiment analysis empower businesses to make informed decisions about product features, pricing strategies, and distribution channels—all of which drive increased sales and market share.

Today’s customers demand personalized experiences, and consumer insights are the key to delivering. By tailoring messaging, products, and services to the unique needs and preferences of your audience, you can boost customer retention and minimize churn.

Every brand operates within unique market dynamics, and uncovering valuable consumer insights unlocks a wealth of opportunities. These insights allow you to identify common customer pain points and address them directly, enhancing the overall experience. But that’s just the beginning—let’s dive into more benefits!

The pandemic accelerated digital transformation worldwide, fundamentally reshaping commerce and customer behavior. Today’s consumers are more informed and intentional than ever, carefully researching brands that align with their values and amplifying emerging market trends through online conversations.

In response, brands are racing to harness business intelligence that reveals deeper insights into customer behavior and the journey they take. It’s easy to spot a brand that’s agile, predicts customer churn, and swiftly addresses consumer pain points—it’s not luck. It’s the result of leveraging strategic consumer insights to take decisive action. Let’s explore how they make it happen.

Just as aerodynamics improves fuel efficiency and speed, consumer insights optimize your marketing efforts by uncovering critical data like customer sentiment and trending topics. Social data analytics sheds light on your audience’s preferences, the nuances of their conversations, and the subtopics they engage with throughout their journey.

These insights are invaluable for storyboarding campaign ideas, as they highlight the topics your customers care about most. You’ll also identify where your audience gathers, ensuring your messaging reaches them in the right place at the right time. With a detailed understanding of audience attributes, your targeted ads will resonate more deeply, deliver a personalized experience, and ultimately drive higher sales.

Your customers are the lifeblood of your brand, and prioritizing their needs is essential to maintaining your brand’s health. How is your brand perceived? Consumer insights into sentiment, sentiment drivers, customer experience, earned media, and customer interests and needs are invaluable for fostering satisfaction and loyalty.

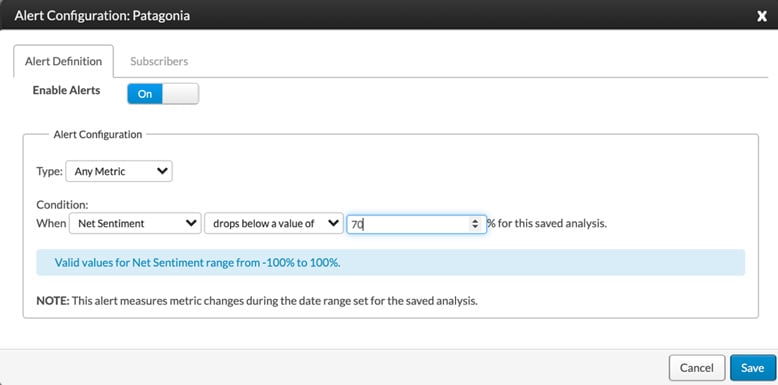

By establishing baseline sentiment metrics, you can set up alerts to detect significant changes or potential issues early. This proactive approach helps you address concerns before they escalate, ensuring you safeguard your hard-earned reputation and build trust with your audience.

No matter how well a campaign performs, there’s always room for improvement. Once you’ve built your marketing campaign strategy on customer insights, you can use them and conduct market research to measure your success within your target market. Not only that, but you can tweak messaging mid-campaign or use what you’ve learned to make your next one even more successful.

Consumer insight research focused on a competitor’s audience can be a powerful tool for building effective strategies. By leveraging social listening, you can access competitor data and consumer insights to uncover pain points and identify opportunities to outperform the competition.

Understanding where consumers are discussing their experiences and grievances with a competitor is the first step. With this knowledge, you can craft targeted messaging to address their concerns directly, drawing dissatisfied customers toward your brand. Additionally, these insights can guide product development and placement, allowing you to meet the needs of this audience and even carve out new market opportunities.

Building a vibrant online community around your brand is well worth the effort. It’s a great way to enhance customer interactions, attract like-minded customers, and increase customer loyalty. An active community is also a rich source of user-generated content (UGC) that works better than brand messaging to win converts to your brand. Use consumer insights to expound on what your community loves and provide solutions to their pain points.

Customer insights can inform your R&D through launch day and beyond. Using them to guide customers’ wants and needs ensures your products exceed customer expectations, and your messaging educates your audience. Customer insights also help you take the market’s temperature before release day to avoid conflicts, minimize competition, maximize visibility, and attain the warmest reception possible.

Gathering voice-of-customer (VoC) intelligence has long been a challenge for brands. Traditional research methods often fall short when it comes to keeping pace with the rapid shifts in customer perceptions. By the time data is collected and analyzed, competitors may have already gained the upper hand.

To stay ahead, many brands are now conducting market research and consumer insight analysis either in-house or through specialized agencies. In today’s fast-moving digital landscape, precision and speed are essential. Artificial intelligence surpasses human capabilities by quickly decoding sentiment, identifying sentiment drivers, and segmenting customers by demographics, interests, beliefs, and more—across any topic.

This advanced market research offers clarity into consumer perceptions and highlights where key conversations are happening. With these insights, you can ensure your messaging resonates and reaches the right audience, avoiding the risk of being out of sync with consumer expectations. VoC intelligence also serves as a launchpad for exploring a wide range of strategic opportunities, setting the stage for impactful decision-making.

Prioritizing customer happiness is crucial, especially since retaining an existing customer is more cost-effective than acquiring a new one. Social listening allows you to tap into brand conversations, uncovering valuable insights about your sales funnel, customer service performance, and the overall customer journey.

These analytics provide a clearer view of your customers’ experiences, highlighting common pain points and challenges that can be addressed to improve interactions and build stronger relationships. By streamlining customer experiences, you not only enhance satisfaction but also drive retention and strengthen your bottom line.

When issues arise, customers often take to social media to voice their concerns. Consumer insights can pinpoint where these discussions are gaining momentum, how much your net sentiment has dropped, the key authors driving the conversation, and the trending terms or hashtags involved.

This intelligence provides a clear picture of the crisis and equips you with the details needed to address the issue directly. In such scenarios, speed is critical. Setting alerts around baseline metrics like sentiment and conversation volume ensures you’re notified early, allowing you to respond before the situation escalates.

Brands can obtain customer insights from various data analytics sources, including customer service data, product and service evaluations, blogs, forums, customer feedback and online reviews, market research, social media analytics, customer purchase history, and customer sentiment. These provide valuable insights and identify areas to maximize the customer’s lifetime.

Customer insight managers generally respond to questions when marketing new ideas and products. Customer insight managers can assist brands in anticipating their customers’ wants and needs, loves and hates, by gathering and combining relevant, targeted customer data about their audience. This helps brands give what customers expect, provides a better customer experience, and results in more revenue.

Putting Consumer Insights to Work

Consumer insights provide the critical information brands need to chart a successful course. While you might predict how customers will respond, there’s no need for guesswork—social media acts as a 24/7 pulse check on consumer behavior.

Market trends are closely tied to customer perceptions, and staying in sync with these trends ensures your brand moves in the right direction. By analyzing relevant online discussions, you can refine your marketing strategy, decide whether to launch a new product, adjust packaging, or amplify your presence on a particular platform.

Take the food industry as an example of shifting consumer behaviors over the past three years. In 2020, the pandemic reshaped how and where people got their meals, driving explosive growth in grocery delivery, curbside pickup, in-app orders, and meal kits. At the same time, home cooking became a widespread trend.

Now, with many parents back at work—either in the office or remotely—and life resuming a faster pace, the food category continues to evolve. Consumers still prioritize health-conscious eating but want to avoid spending their evenings tied to the kitchen. Eating out isn’t always feasible or appealing, especially with rising inflation.

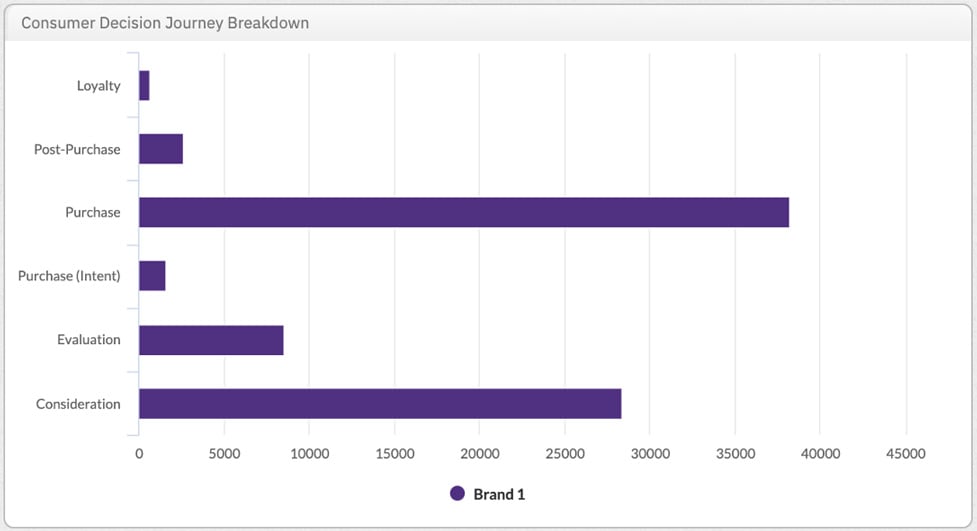

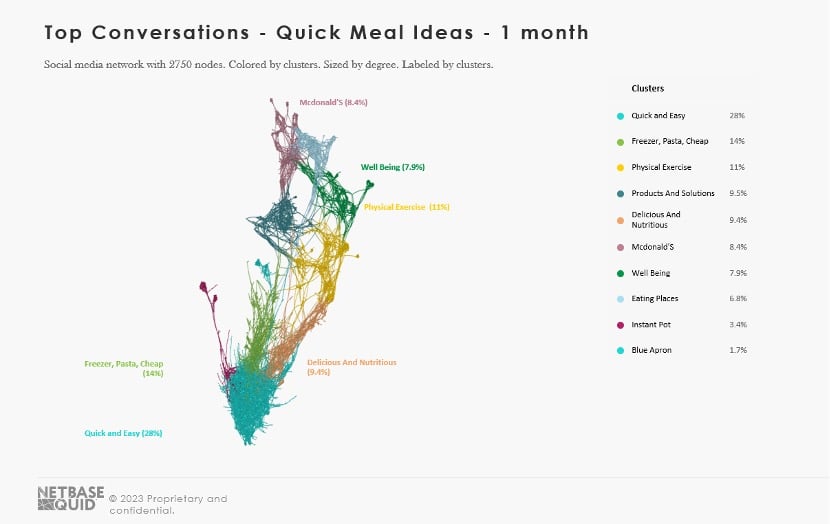

Market research and consumer insights shed light on these changes. Conversations around quick meals reveal customer demand for fast, convenient, yet nutritious options. Quick-serve restaurants are part of the discussion, but clusters of feedback highlight a broader interest in meal solutions like meal kits and easy prep ideas. Companies like Blue Apron remain popular, suggesting new opportunities for brands to explore within this space.

By applying these insights, brands can align their strategies with consumer needs, unlocking potential in evolving markets while staying one step ahead of trends.

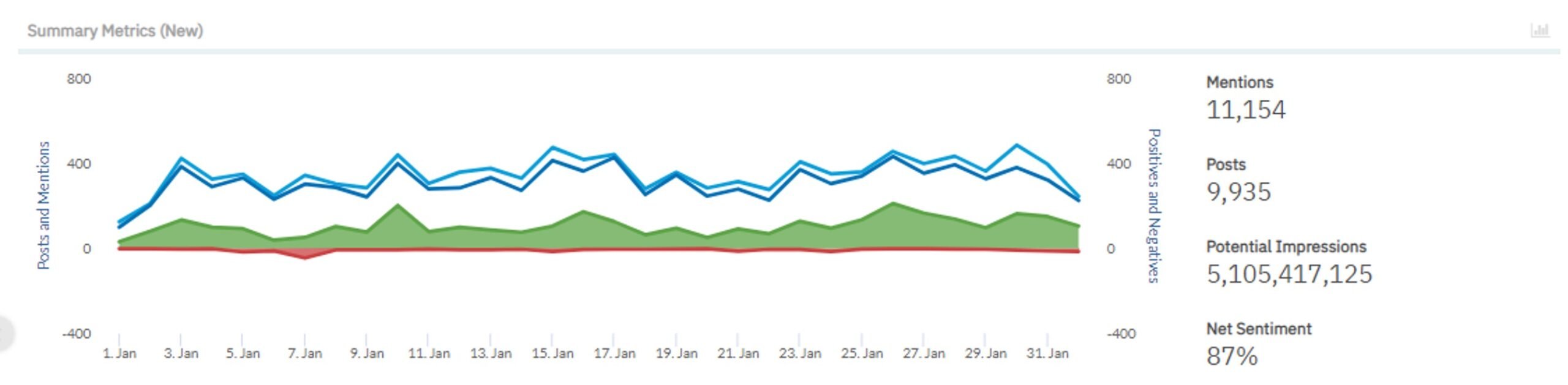

We can break this down further through social listening. It can offer feedback on the conversation volume over the past month—and it’s been steady. Additionally, we can see sentiment; customers still favor this subject with a positive 87% on a scale from -100 to 100.

A wealth of actionable insights are available within this topic to help brands position themselves for success. Demographic data reveals women are leading the conversation at 58% versus men at 42%. 25-34 4-year-olds lead the discussion at 17%, followed by the 35-44 and 55-64 age brackets tied at 15%.

Using timestamp data, we find customers most likely to be searching and discussing quick meal ideas at 2 pm and 5 pm. Ensuring your messaging and recipe ideas hit social feeds at these times will help maximize your traction. We can also quickly find the top authors, domains, and channels where the discussions occur. Getting the word out on these avenues at the right time is critical.

High-quality and actionable data such as psychographic intel (interests, beliefs, lifestyles, and emotions) also play an essential role. For instance, consumer insights that unveil unrelated interests can help businesses identify areas of white space and new markets they can target for further traction. Below we see consumer interest in the fast meal-prep conversation.

You’ll notice that travel, pets, and food and drink are indexing highly—a change from last year when health/fitness and fashion were indexing highly—this emphasizes the need to monitor your audiences continuously for changes. Pivoting as needed and appealing to these market needs and consumer interests isn’t a massive leap for food-centric CPG brands and indicates how to spin your messaging for the best reception.

While your customers have countless dimensions to explore, the consumer insights and use cases highlighted here provide the most impactful opportunities for enhancing your marketing strategy. Every brand is unique, and your specific needs and circumstances will determine which insights hold the most value.

What’s universal, however, is the importance of diving into the conversations surrounding your products for an authentic understanding of the voice of the customer. Enterprise social listening elevates your in-house customer data, offering a comprehensive view of how customers feel about any topic. This empowers your brand to strengthen relationships, improve retention, enhance loyalty, optimize the customer journey, and refine marketing efforts—ultimately driving revenue growth.

With Quid, you gain access to world-class social listening and consumer insight analysts that transform consumer conversations into actionable insights tailored to your brand’s goals. Let us be your resource for customer insights. Reach out for a demo, and we’ll show you how Quid’s advanced tools deliver the intelligence you need to succeed.