Quid Marketing

The ceremony has not yet taken place, but the conversation around it is already defined.

From August 2025 through February 2026, Oscars discussion reached significant scale and settled into clear patterns. Volume is high. Tone is predominantly neutral. Participation skews younger. Attention is spread across multiple themes rather than concentrated around one film or controversy.

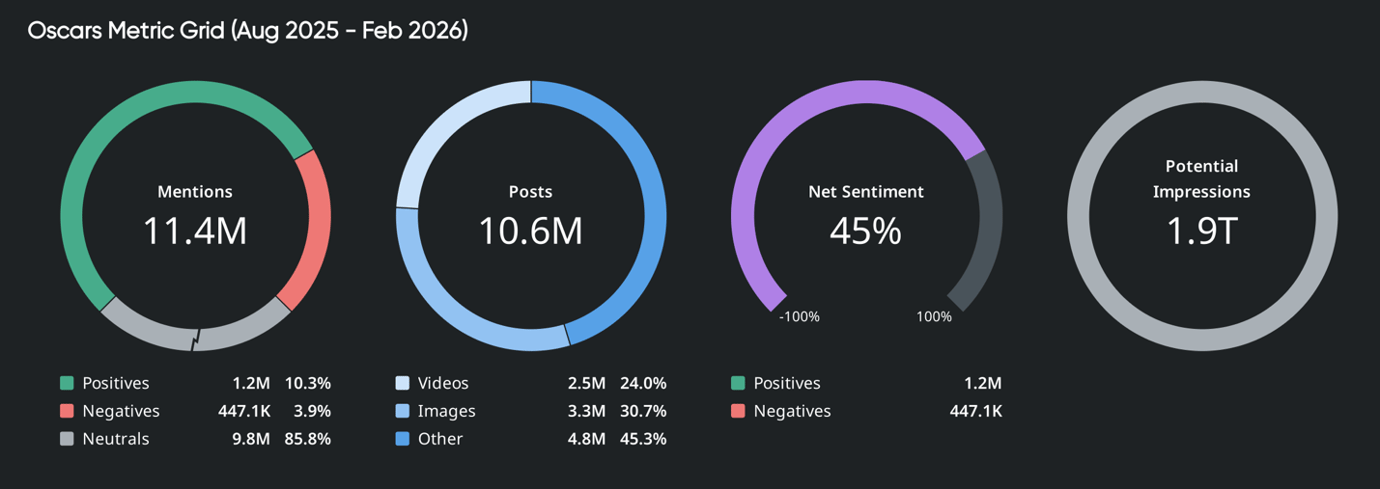

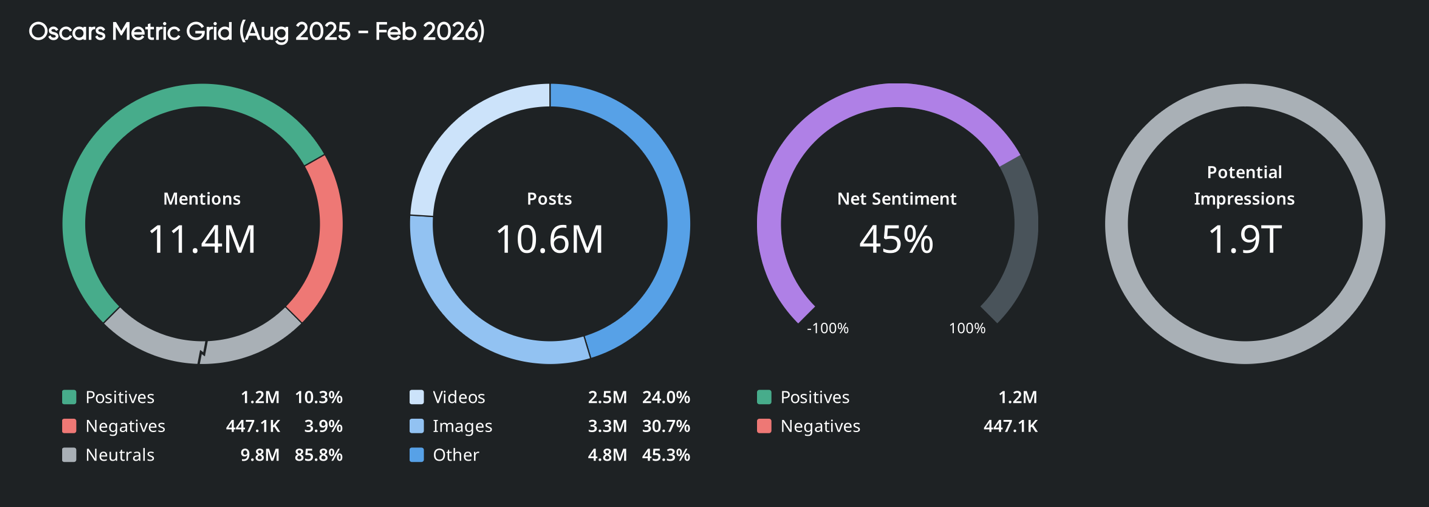

From August through mid-February, Oscars discussion generated 11.4 million mentions and 1.9 trillion potential impressions. Neutral posts account for the majority of volume. Positive posts outnumber negative ones, with negative sentiment representing just 3.9 percent of total conversation.

Most activity centers on nominees, predictions, performances and campaign positioning. The tone reflects evaluation rather than reaction.

More than half of all content is visual: 30.7 percent images and 24.0 percent video, reinforcing how heavily this conversation relies on shareable media formats.

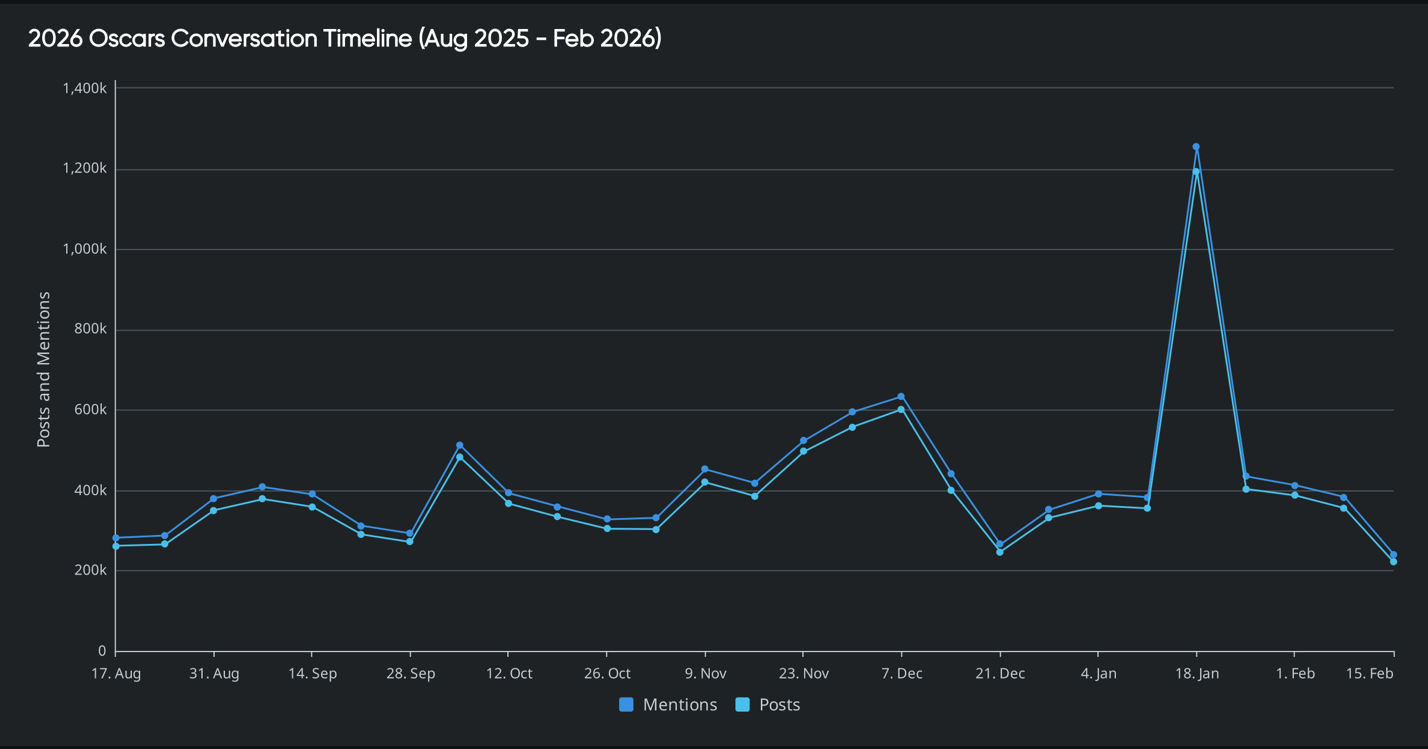

The timeline shows a steady baseline of activity from late summer through early winter, followed by clear peaks tied to major awards-season moments.

Visible increases align with:

The largest spike in the dataset occurs in mid-January, immediately following the announcement of Academy Award nominations. That moment produces the highest single surge in posts and mentions across the measured period.

Earlier spikes in December align with Golden Globes coverage and subsequent industry reactions. Smaller but noticeable increases in late November and early December correspond with critics’ awards announcements and momentum shifts among frontrunners.

The network's structure only tells part of the story. The demographic and interest signals show who is sustaining it.

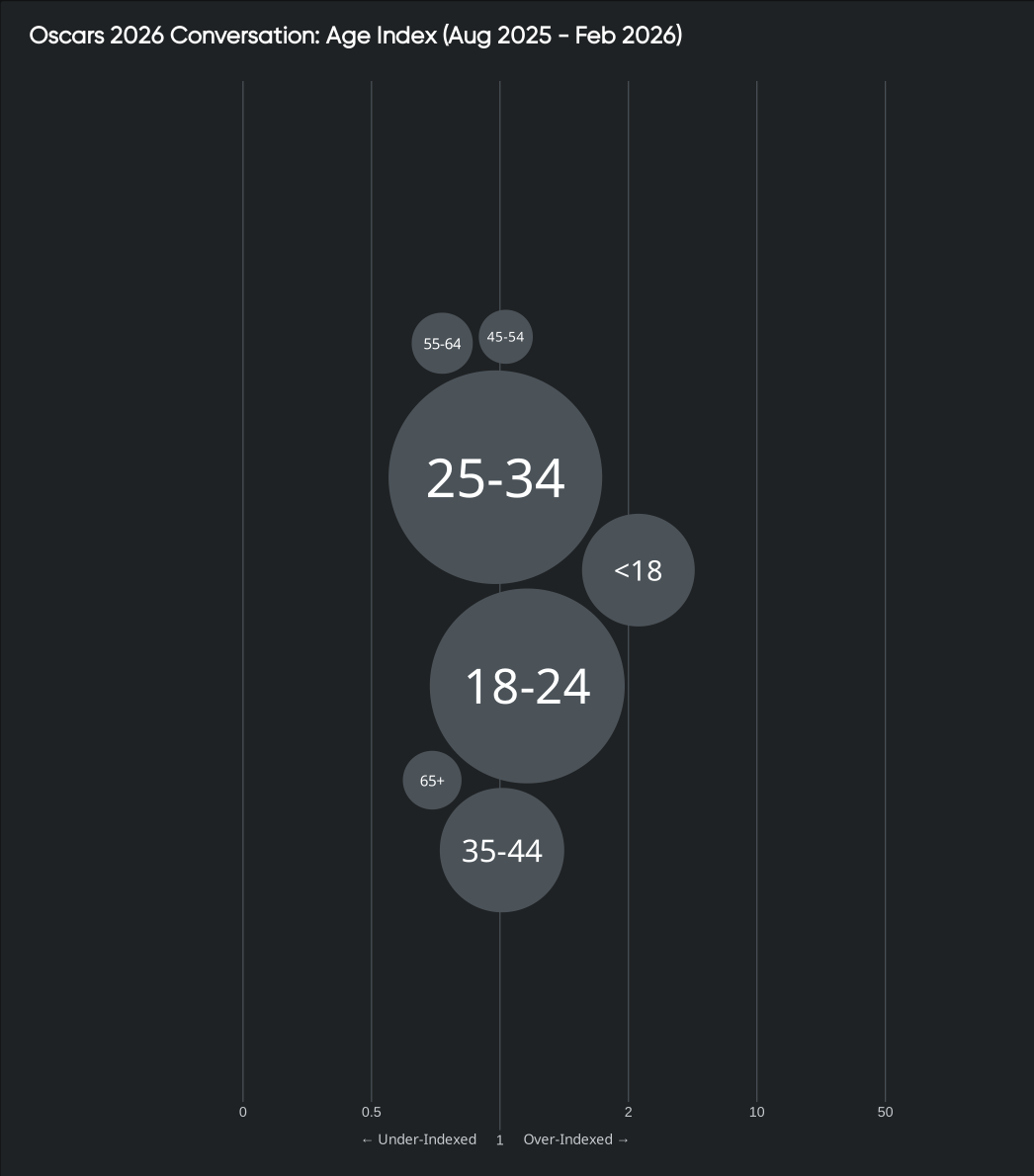

Participation over-indexes most strongly among 25–34 and 18–24 audiences, with 35–44 slightly elevated as well. Older segments index lower relative to baseline. The core of the conversation sits inside younger cohorts.

That matters because it aligns directly with the adjacent interests that over-index in the dataset.

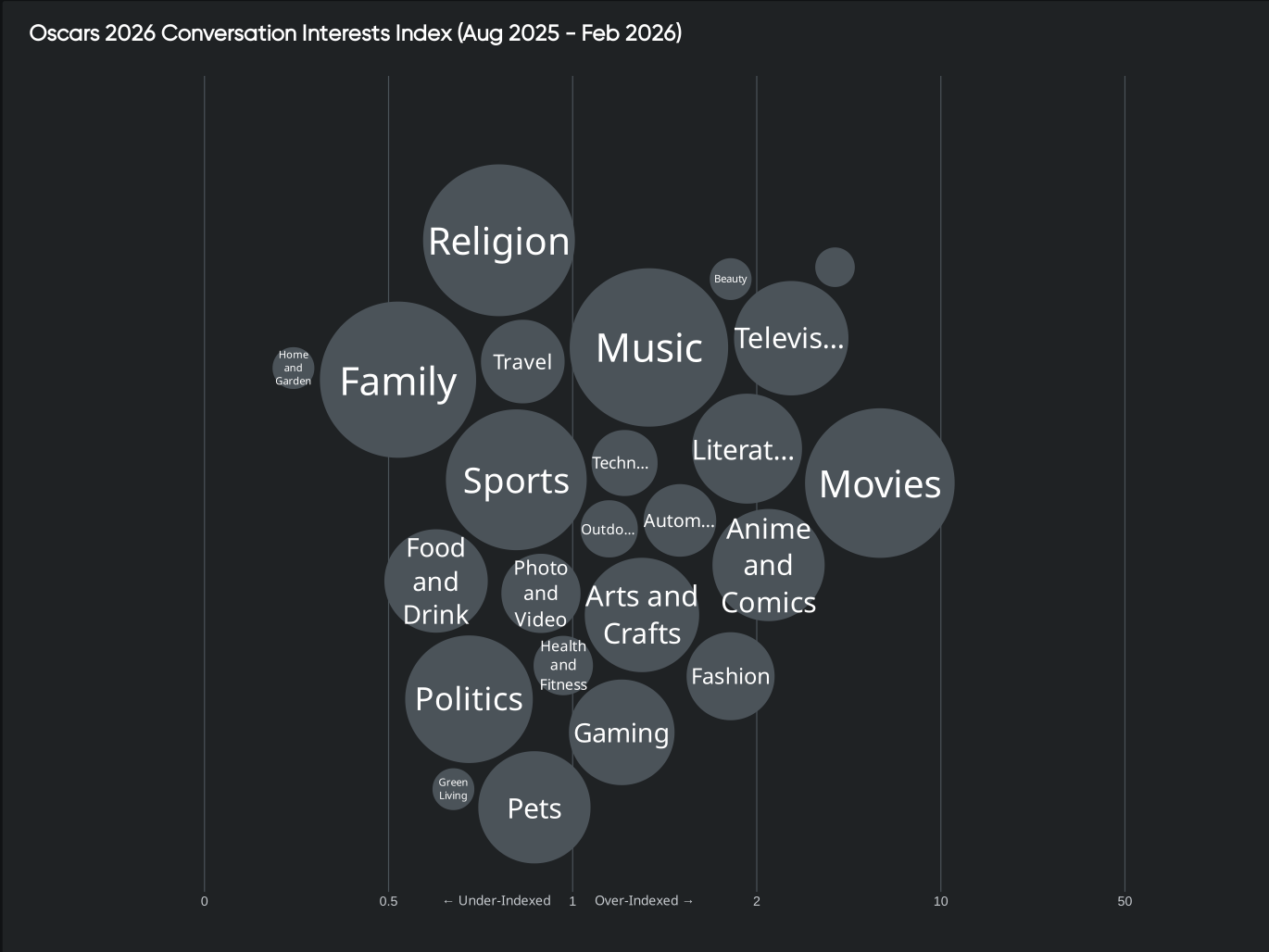

Music, movies, fashion, photo and video, and politics all show elevated indexing. This is not a purely film-centric audience. It is culturally layered.

Music visibility connects directly to the “Impact of Original Song” cluster. Fashion intersects with red-carpet coverage and designer amplification. Politics aligns with clusters centered on global and social themes. Photo and video interest mirrors the high percentage of image and video-based content circulating in the metric grid.

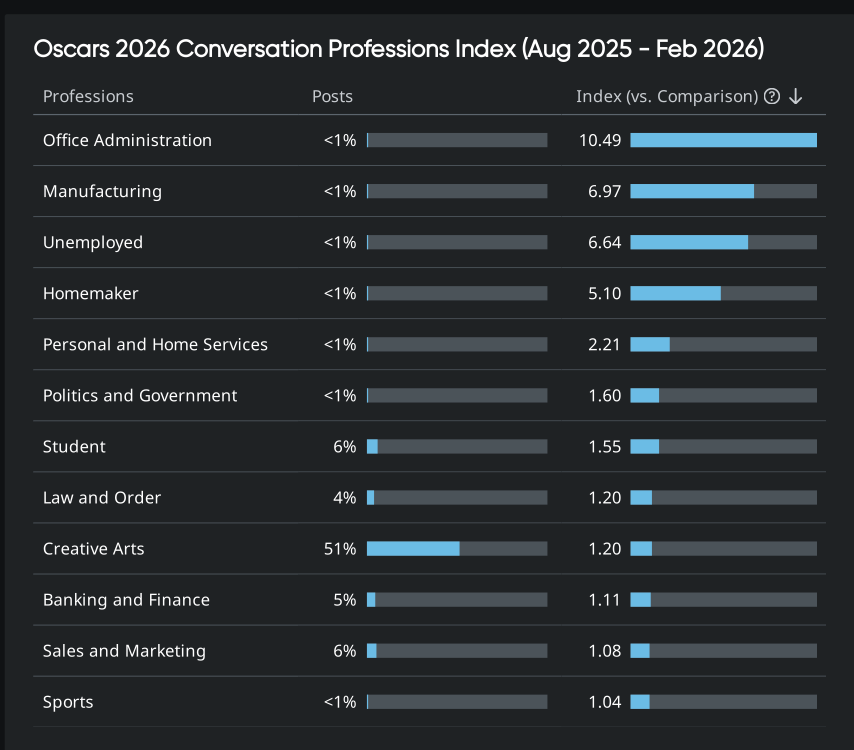

The interests reinforce the network structure and professional background patterns deepen that picture.

Creative Arts and Students over-index, alongside Politics and Government and Law and Order.

The conversation is not only fan commentary. It includes people connected to creative industries, academic environments and civic spaces. That participation profile mirrors the cluster themes we saw earlier:

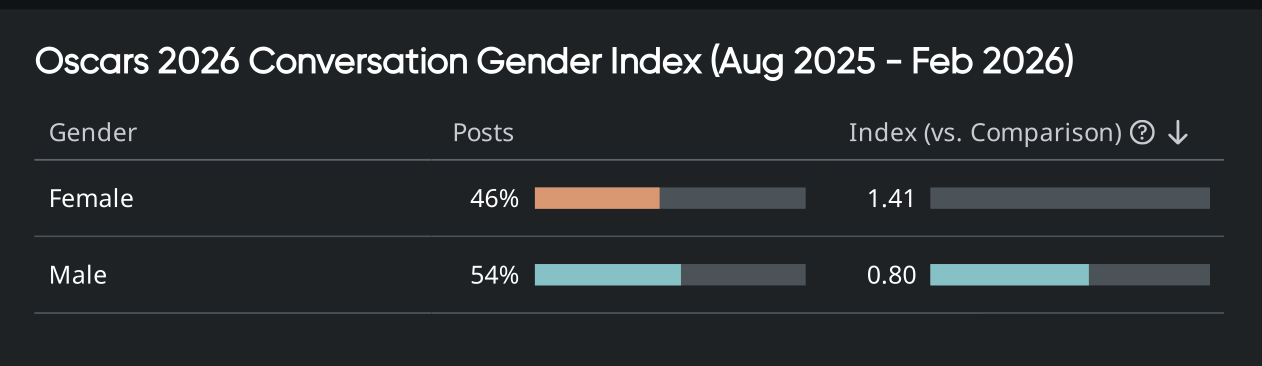

The audience composition aligns with the thematic spread of the conversation, while gender distribution remains relatively balanced. The split is 54 percent male and 46 percent female. There is no extreme skew in participation.

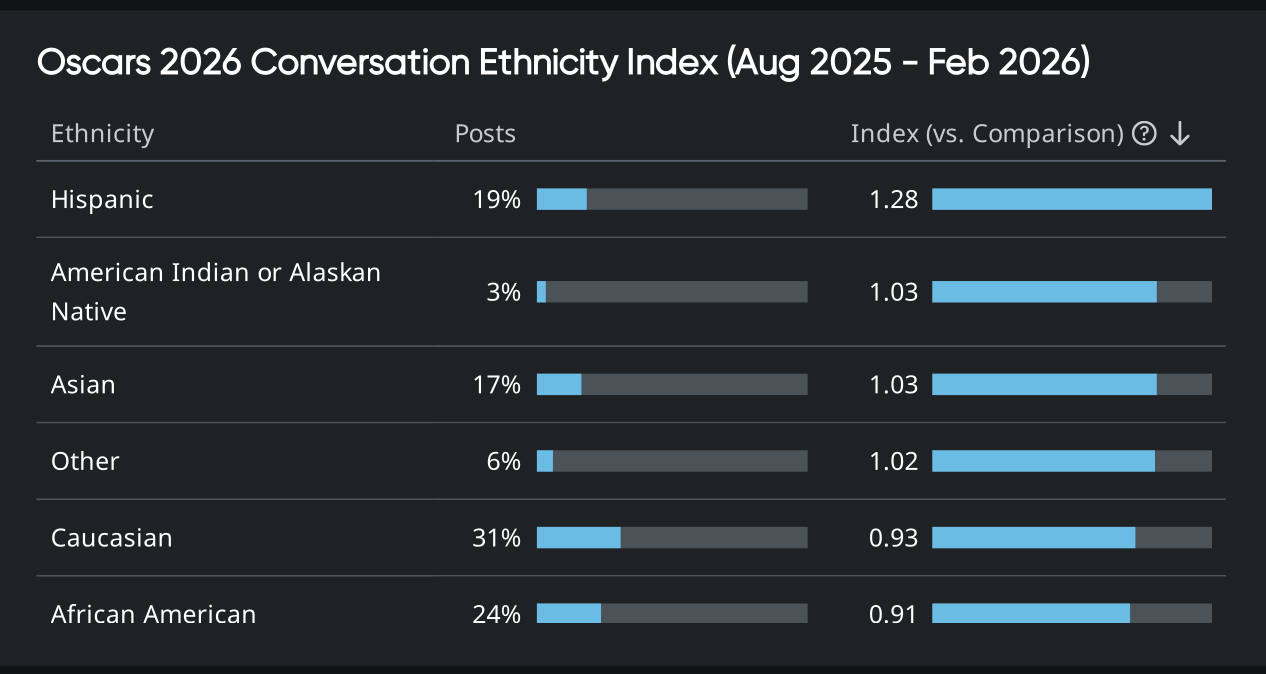

Representation across ethnicity also varies within the dataset. Hispanic participation over-indexes relative to baseline. Asian and African American segments index near or slightly above baseline. Caucasian participation indexes slightly below baseline compared to the comparison set shown in the chart.

The conversation is demographically varied rather than dominated by a single segment.

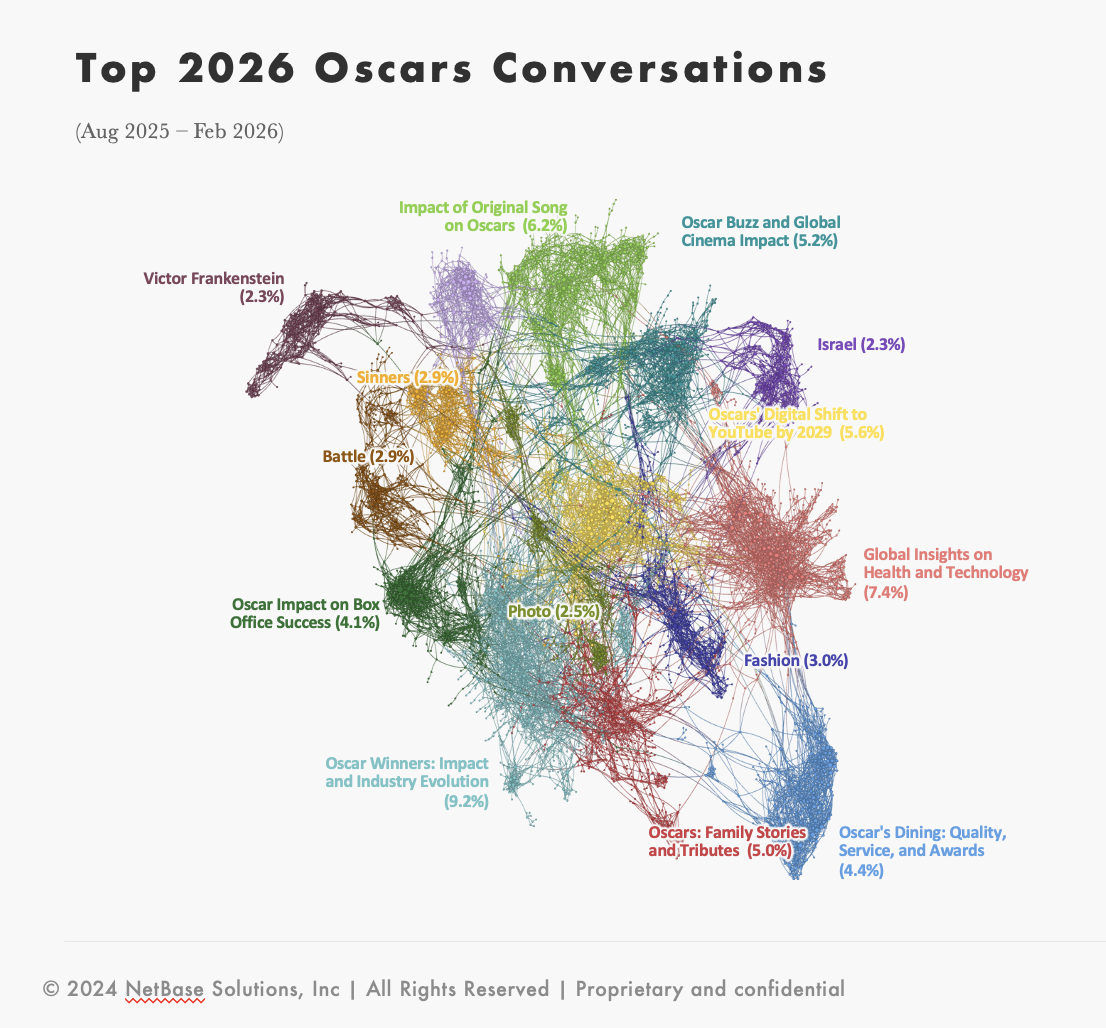

The Oscars conversation ahead of the ceremony is multi-domain, multi-segment and structurally fragmented across cultural, economic and industry narratives. It is not centralized around a single dominant theme.

No single cluster dominates the structure. The largest thematic group accounts for 9.2 percent of total share, with several others close behind.

That distribution matters. It means attention is spread across multiple themes rather than concentrated on one runaway frontrunner or controversy.

Here is what the largest clusters represent.

This cluster centers on a discussion of what wins mean beyond the ceremony itself. Posts in this group focus on:

This is where people talk about what the Oscars represent — not just who wins.

This cluster reflects films and narratives intersecting with larger global themes. Conversation in this group includes:

It shows that awards-season discussion extends beyond entertainment into policy and societal spheres.

Music is its own momentum engine. This cluster captures:

The interest index supports this overlap. Music over-indexes within the broader Oscars audience. Song categories are not peripheral; they generate standalone conversation.

This cluster reflects structural discussion about distribution. Posts focus on:

This is not ceremony-night talk. It is infrastructure talk. The fact that this cluster commands more than five percent of total share confirms that platform transition is part of the awards narrative.

This cluster captures:

Conversation here connects Academy recognition to international markets and distribution windows.

This segment includes:

It is one of the more sentiment-forward clusters but still sits within the broader neutral-dominant dataset.

Here, discussion centers on measurable outcomes:

This cluster connects directly to economic impact rather than symbolic recognition.

These smaller but distinct clusters show that individual titles generate concentrated discussion communities. They include:

Even at under three percent share each, they form recognizable hubs within the broader network.

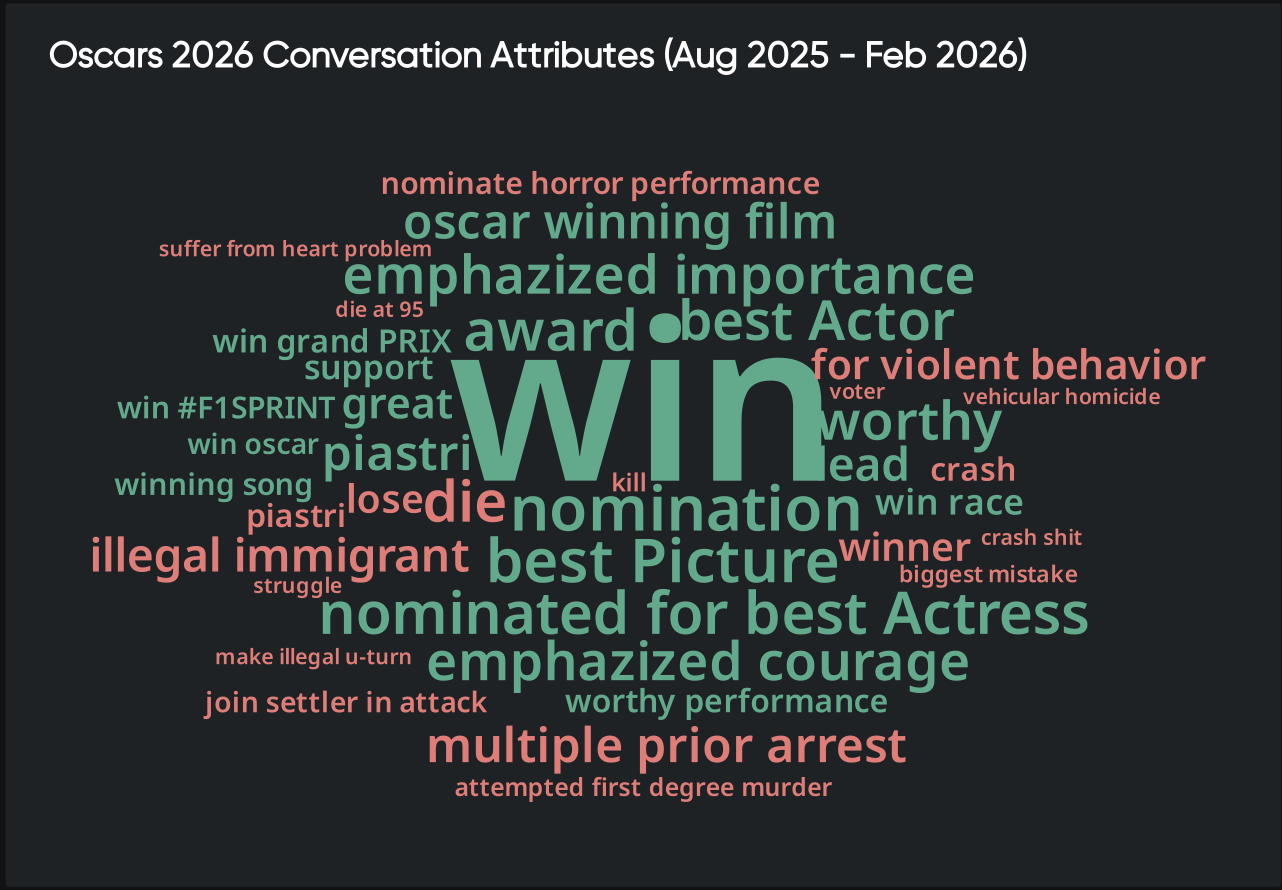

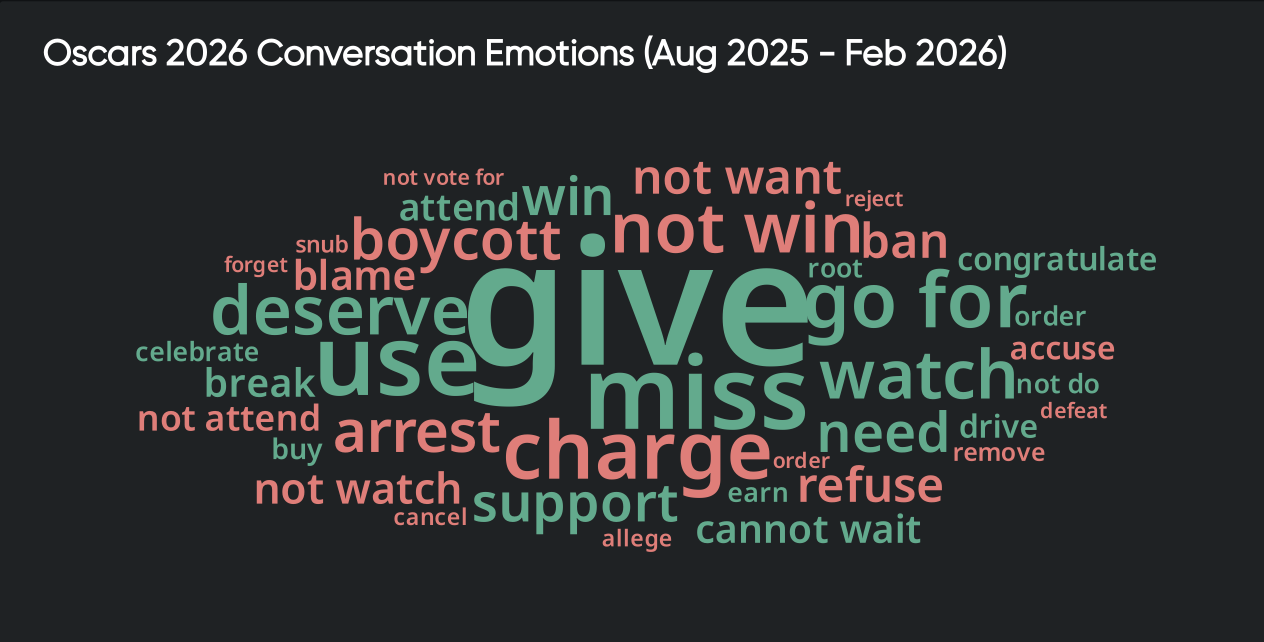

Language patterns show both celebration and disagreement.

These align with the earlier sentiment breakdown: endorsement and criticism coexist within a predominantly neutral dataset.

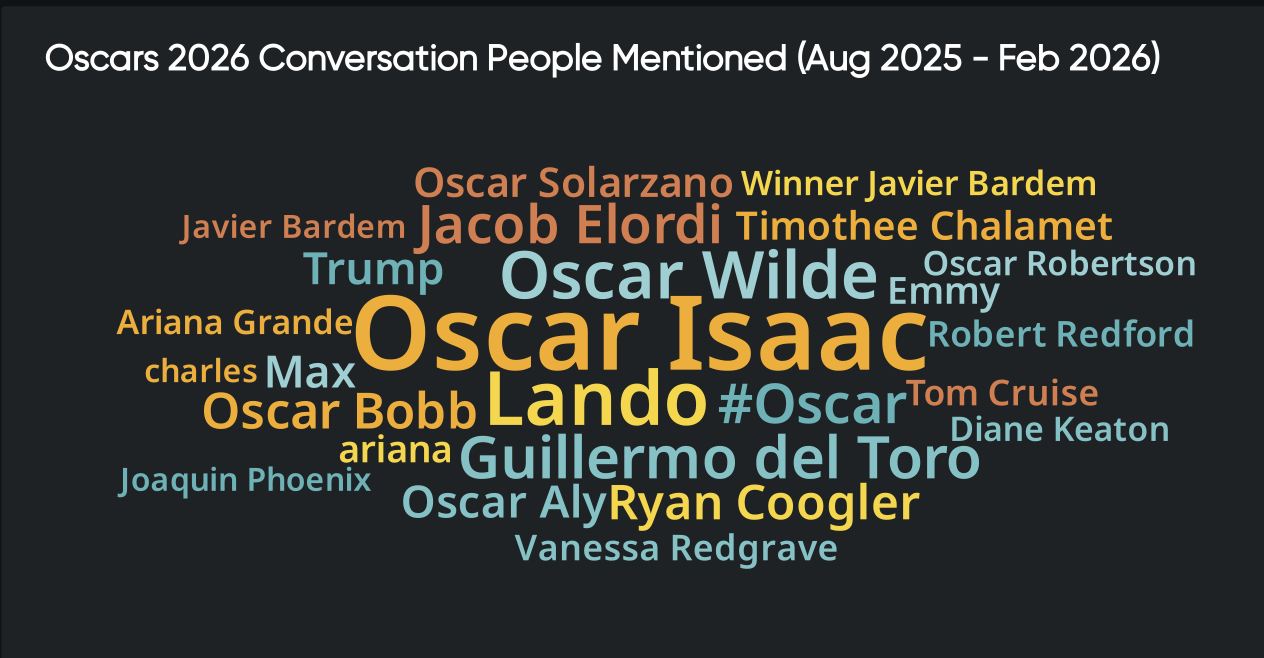

Certain individuals and media links act as amplification nodes.

The popular links chart shows which URLs drive measurable link mentions and impressions. The people-mentioned chart highlights frequently referenced individuals, including Oscar Isaac, Ryan Coogler, Timothée Chalamet, Ariana Grande and others.

These names and links serve as visible anchors within the broader conversation network.

Before the red carpet rolls out, the data confirms:

The Oscars conversation is already organized. It is multi-threaded, visually driven and anchored to specific calendar moments. That structure creates measurable signals well before the ceremony itself.

For brands, studios and media teams, the opportunity lies in reading how attention is organizing in advance. They can discover where momentum builds, which audiences are active, and how adjacent cultural categories intersect. This sort of structural mapping turns awards-season chatter into planning intelligence.

Connect with Quid today to explore how network and audience analysis can inform your upcoming marketing and media strategy.