Quid Marketing

Galentine’s has matured into a repeatable retail moment with distinct shopping missions

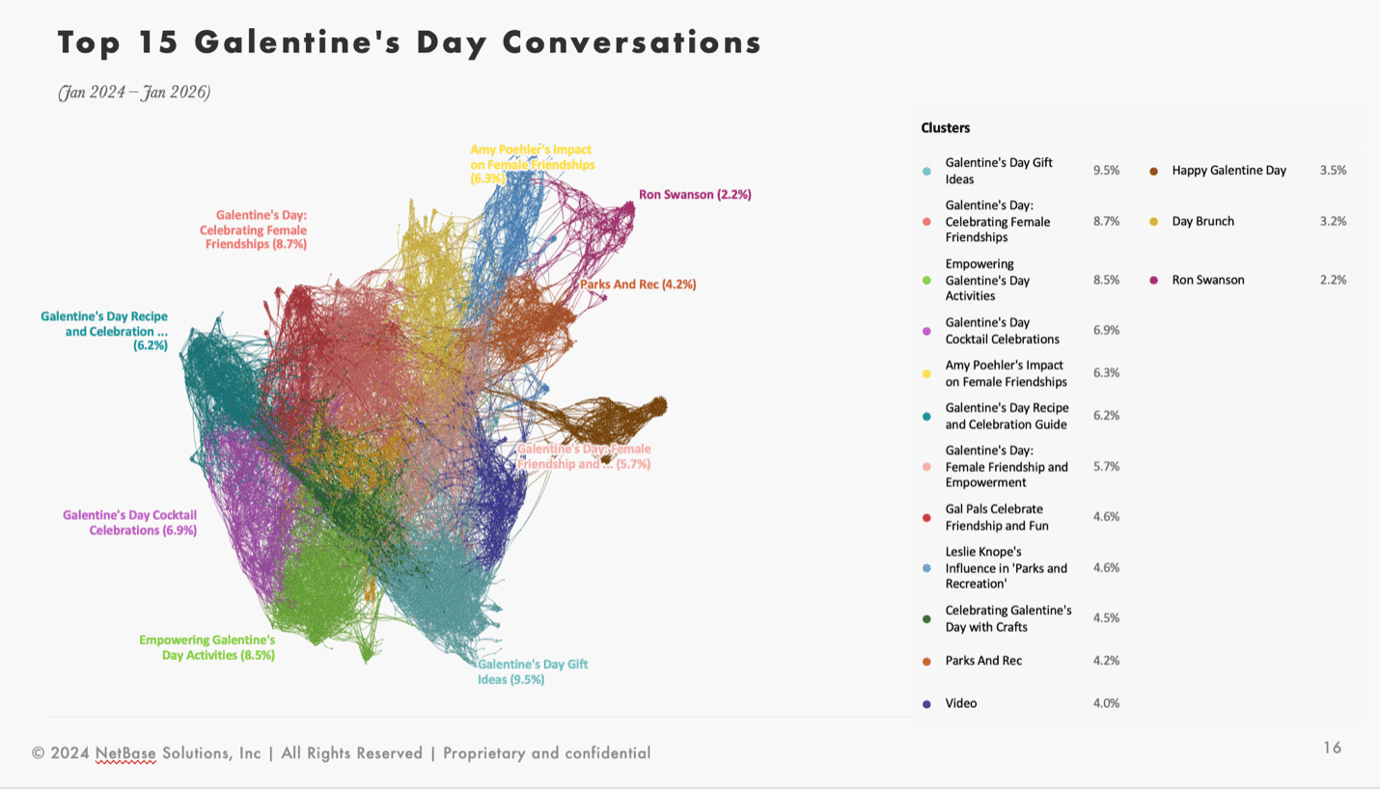

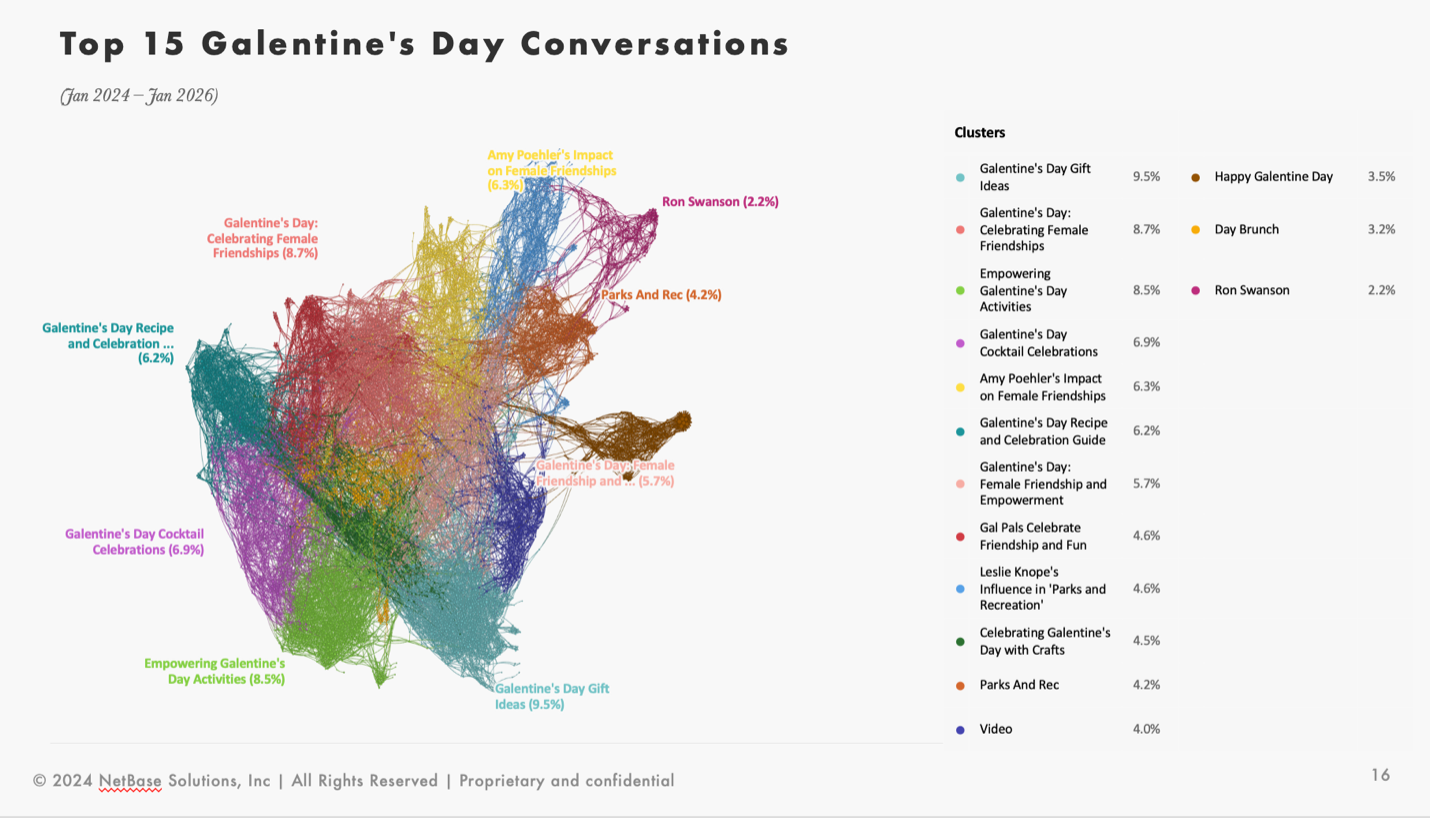

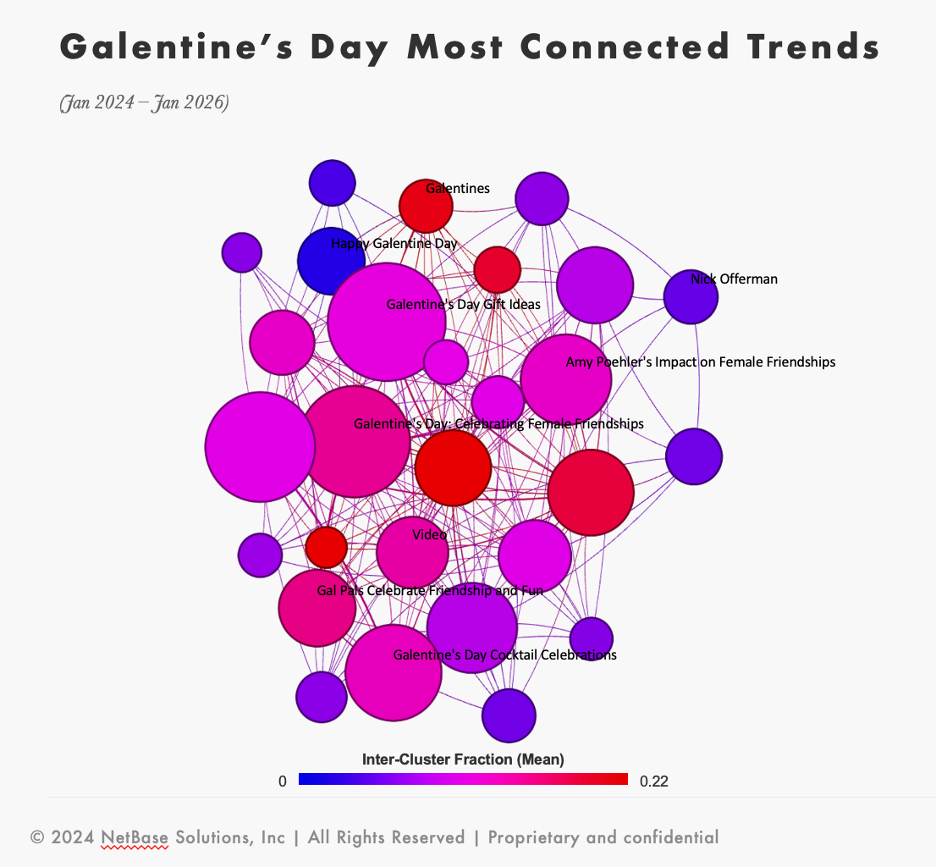

For retailers, the day behaves like a recurring, high-velocity demand window, not a slow-build seasonal theme. The Jan 2024–Jan 2026 network shows the biggest intent lanes. Gift ideas, female friendship celebration, activities, cocktails, and Parks and Recreation references. The Jan 2026 snapshot shows what brands, people and timing signals are most present right now. This combination gives teams a clear playbook for what to sell, what to say, and when to push.

Key takeaways

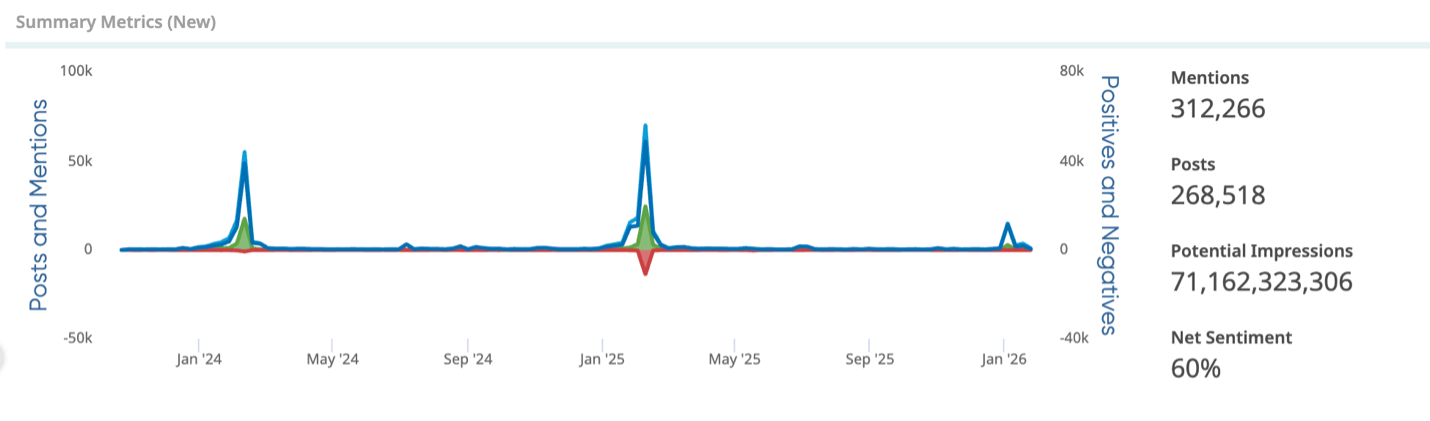

Galentine’s Day buzz does not build gradually. It spikes. The timeline below shows a repeatable surge in conversation concentrated into a narrow window, with the biggest lift hitting fast and then dropping back to baseline.

In this cut of the data, that surge adds up to 312,266 mentions and 268,518 posts, with 60% net sentiment and outsized reach potential at 71,162,323,306 impressions.

Galentine’s Day Conversation 2024 - 2026

The long-range view is useful because it separates durable demand lanes from short-lived memes. It also shows which lanes connect across the network and carry the most influence.

The core lanes are clear

Top conversation clusters across Jan 2024–Jan 2026 include:

The retail implication is that Galentine’s is not a single “Valentine variant.” It is a bundle of shopping missions. Retail wins when merchandising and content map to those missions.

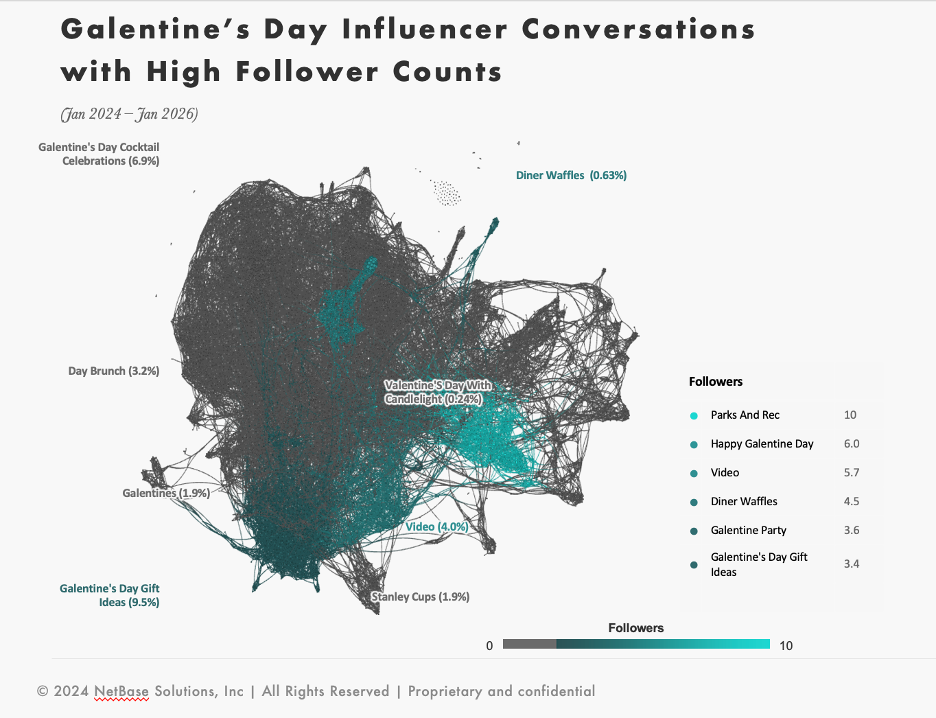

But how can retailers capitalize on this holiday? Influencers lead the way.

In the influencer conversation view, the most visible clusters include Gift Ideas (9.5%), Cocktail Celebrations (6.9%), Video (4.0%), Day Brunch (3.2%), Stanley Cups (1.9%), and smaller ritual cues like Diner Waffles (0.63%).

For retailers, focusing on short videos and photogenic, easy-to-understand items is what will drive real distribution. Product discovery is happening inside “finds,” “haul,” “night-in,” and brunch-adjacent loops.

The most connected trends include Gift Ideas, Celebrating Female Friendships, Cocktail Celebrations, Amy Poehler’s impact, Video, and Galentine-adjacent phrases.

These bridge topics are where conversion improves. Retailers offering gift guides that include hosting cues will perform better than gift-only. Cocktail content that includes “girls’ night” items is easier to shop for than recipes alone.

So, here is some retailer-specific guidance that is designed to work with the spike pattern shown in the mentions chart and the intent lanes in the network.

Build four shoppable lanes that match the conversation structure.

Lane A. Gift ideas that convert quickly

Use tiered assortments and obvious shelf logic that supports fast choice. Supporting media and TikTok insight repeatedly show impulse and curated gifting behavior.

Lane B. Friend-first gathering and hosting

Support the “celebrating friendships” lane with items that turn a purchase into a plan.

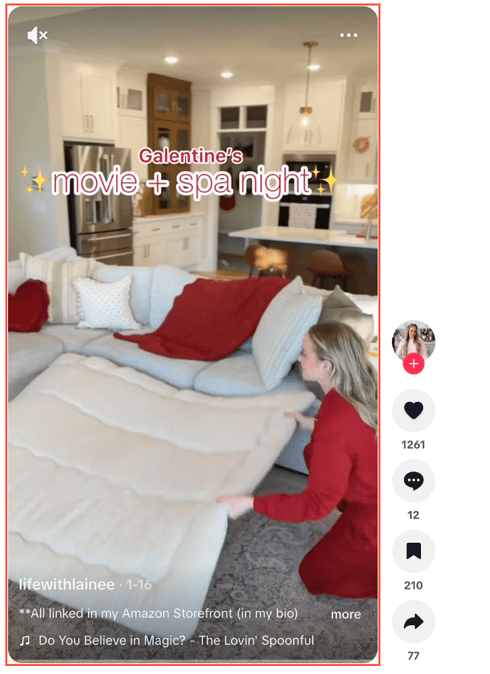

Lane C. Night-in and self-care bundles

TikTok insight emphasizes “Galentine movie night,” spa night, cozy looks, and cross-category baskets.

https://www.tiktok.com/@lifewithlainee/video/7595954170281102623

Retail can package that into fewer clicks and fewer aisles.

Lane D. Brunch and cocktails

Cocktail celebrations sit at 6.9% across the long-range view and brunch appears as an influencer cluster at 3.2%.

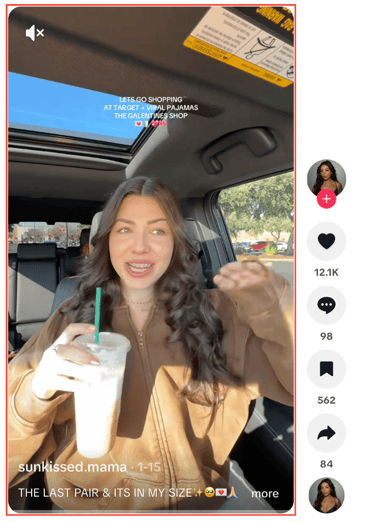

Consumers search and browse by “what they are doing,” not by category taxonomy.

TikTok insight repeatedly highlights scarcity language and last-minute discovery behavior. Retailers can treat that as a feature of the moment.

https://www.tiktok.com/@sunkissed.mama/video/7595785986076839198

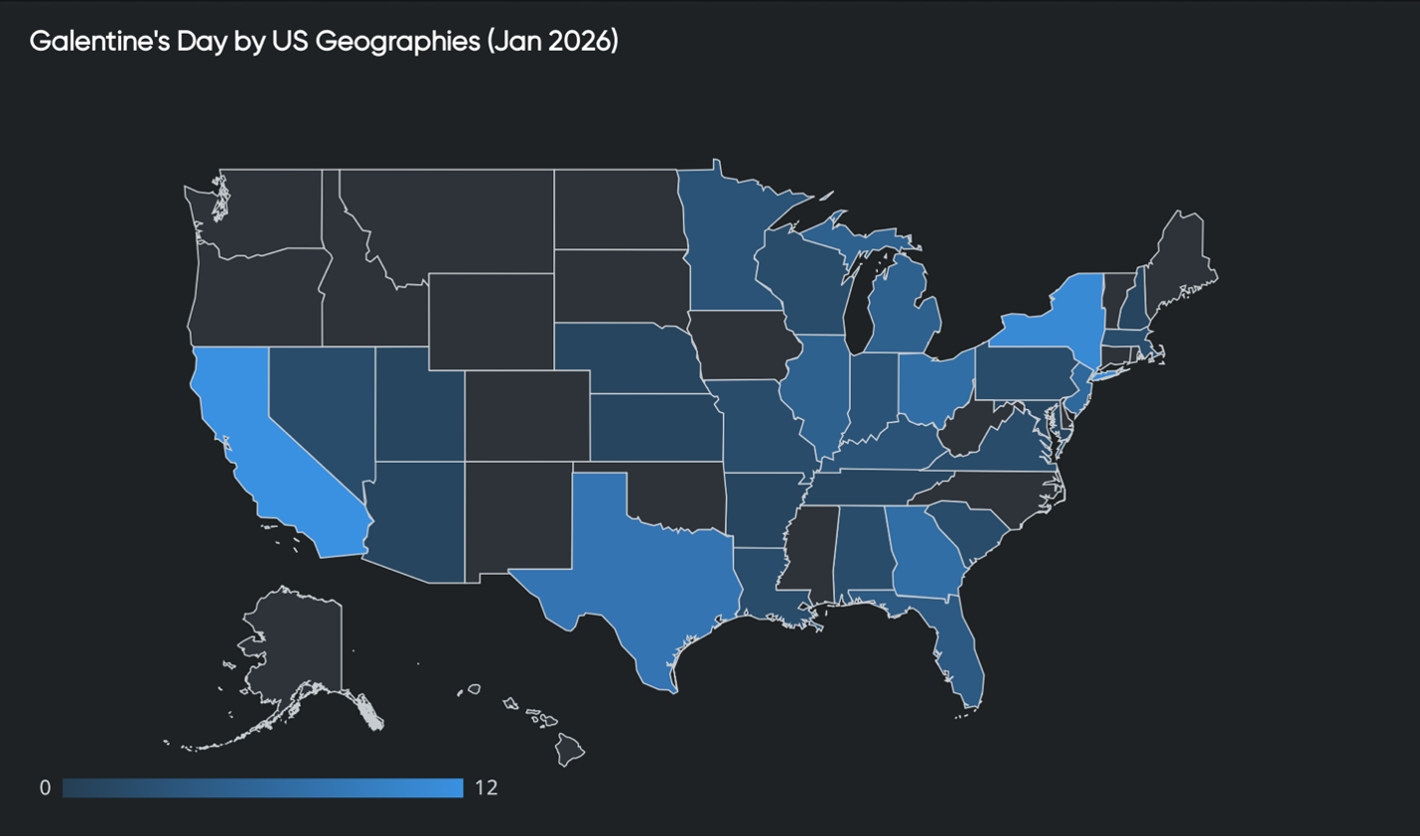

The Jan 2026 geography view shows uneven intensity across the US, with multiple states over-indexing rather than a flat national pattern.

Retailers should prioritize localization where interest is higher. Local event listings, store workshops, and geo-targeted paid support work better when demand is already concentrated.

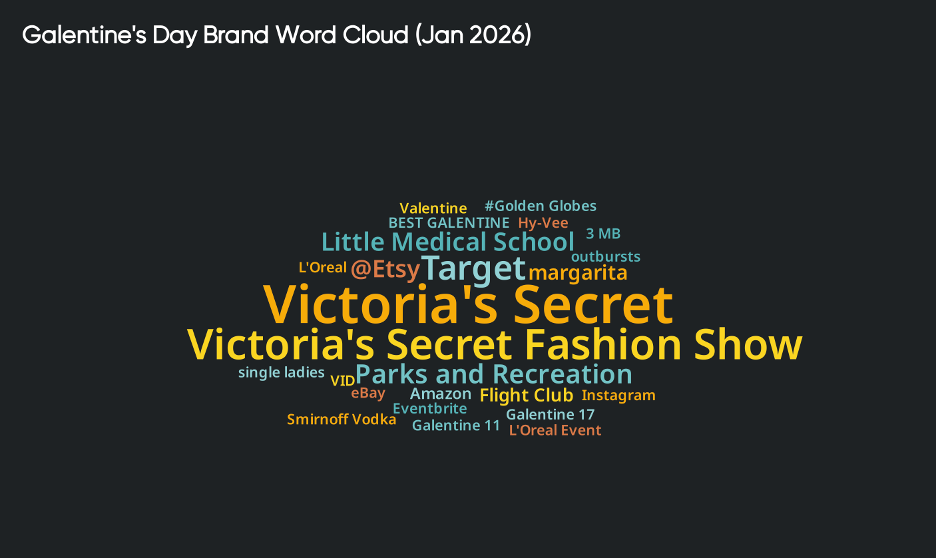

The Jan 2026 brand word cloud surfaces retail anchors and infrastructure terms that align to how Galentine’s gets operationalized. The most prominent terms include Victoria’s Secret and the Victoria’s Secret Fashion Show, plus Target. Supporting terms include Etsy, Instagram, eBay, and Eventbrite.

Retail implication: Galentine’s is both commerce and coordination. Retailers win when they connect product drops, creator distribution, and event tie-ins into one seasonal motion.

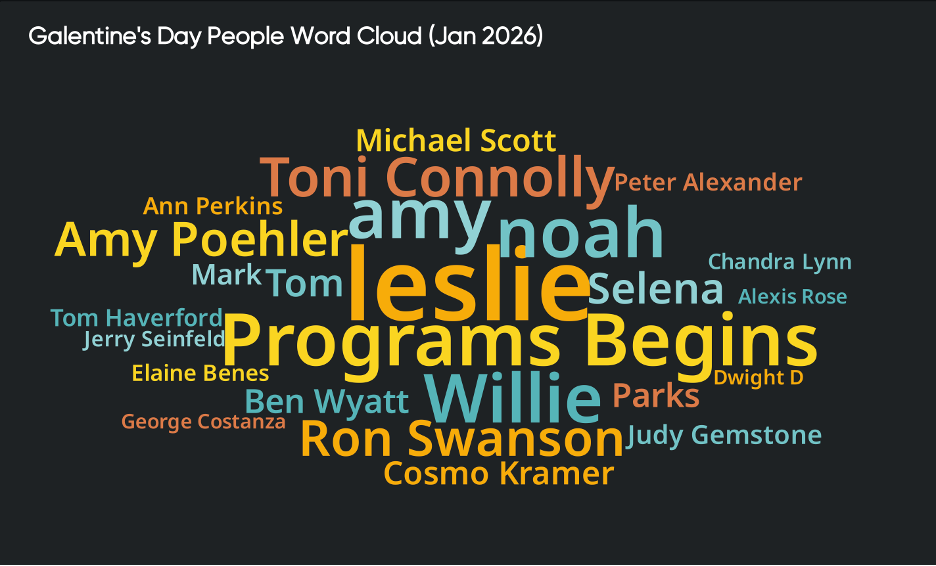

The Jan 2026 people word cloud shows that the conversations are still dominated by the Parks and Recreation origin story. Leslie and Amy Poehler are central, with adjacent character references and sitcom crossovers in the long tail.

This aligns with the narrative themes for Jan 2026.

For retailers, it’s crucial to note that the creative does not need to explain the holiday. Light pop-culture cues and friend-first language keep Galentine’s Day recognizable without turning the campaign into a fandom deep cut.

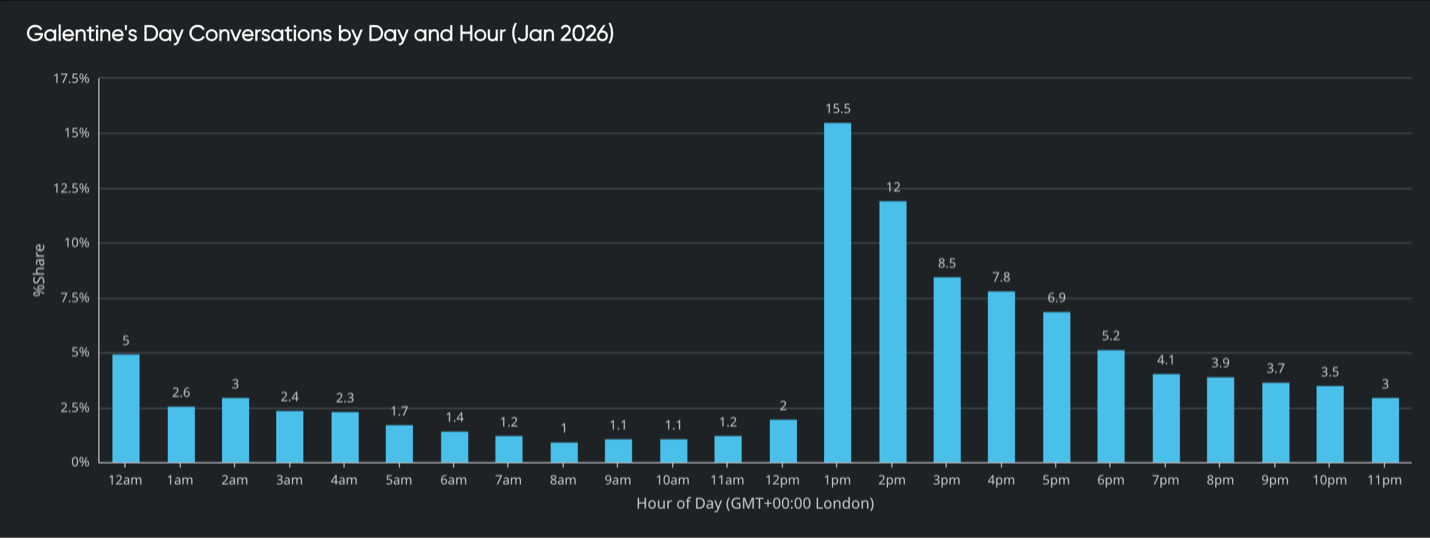

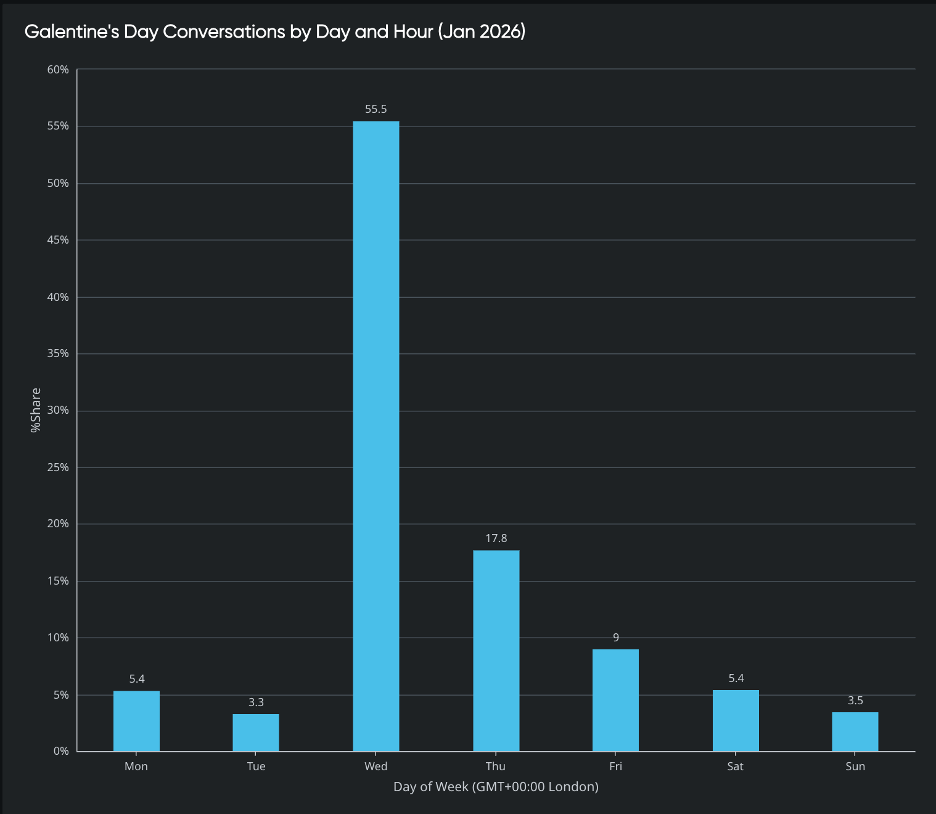

The timeline chart shows the conversation is likely to spike again in early February. And we can narrow this down to a more specific timing as well. The hour-of-day view peaks in the early afternoon in the chart showing the time zones below. The day-of-week view shows Wednesday as the strongest day.

This means retailers should schedule seasonality like a release.

Reach out today to learn how to capture Galentine’s Day sales for your brand!

What is the primary retail opportunity in Galentine’s Day?

Galentine’s concentrates multiple buying paths into a short window. The strongest lane is gift ideas, followed by friendship celebration, activities, and cocktails. Retailers can convert more demand by merchandising by mission and bundling across categories.

What product categories align best to the conversation lanes?

Giftable items, hosting essentials, self-care bundles, cozy apparel, and food and beverage bundles align directly to the biggest clusters and influencer-led formats across Jan 2024–Jan 2026.

How should retailers time Galentine’s content and drops?

The season spikes quickly in early February, and the 2026 snapshot shows afternoon concentration by hour and Wednesday strength by day of week. Retailers should schedule drops and paid boosts to those higher-share windows.

Why does the Parks and Rec origin story matter for retail?

It reduces explanation. Consumers recognize Galentine’s through familiar cultural cues, which makes gift guides, themed edits, and friend-first bundles easier to click and share.