Hydration has emerged as a key consumer priority in 2025.

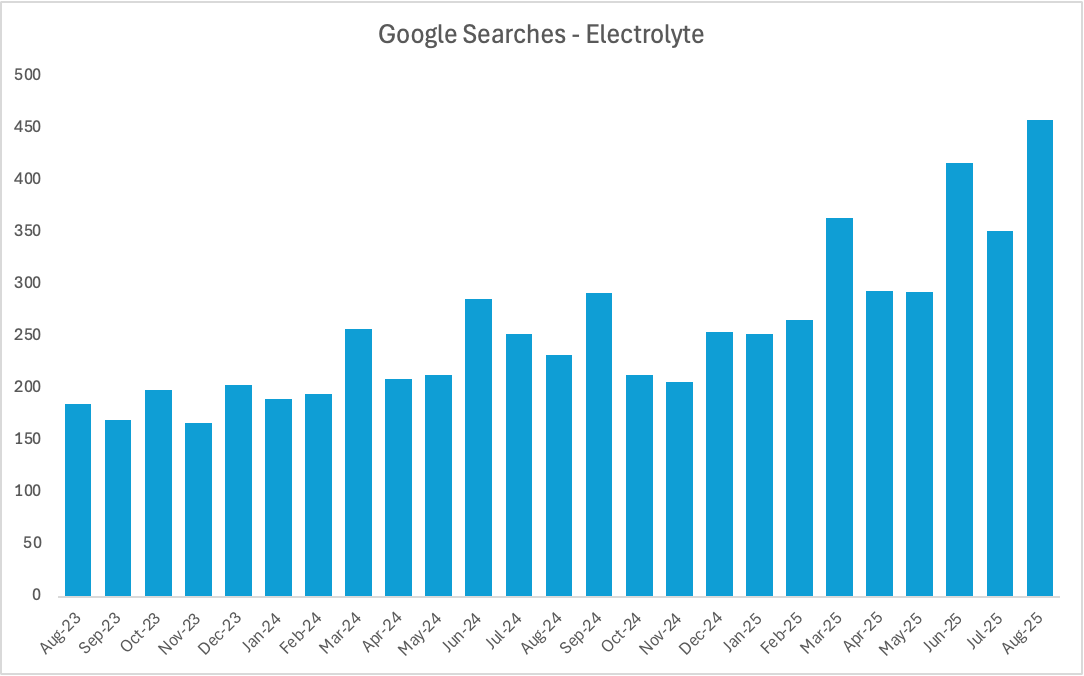

Looking at TikTok only, year-on-year conversations about Hydration grew by 14% whilst conversations about Electrolytes have grown 23%, on Google year-on-year searches for electrolytes have grown by 30%, particularly picking up momentum this summer (2025). (comparing Sep-23-Aug’24 with Sept’24 - Aug’25).

Additional data suggests that in October 2024, Google searches for electrolytes in the UK were four times higher than searches for energy drinks.

So, What is This All About?

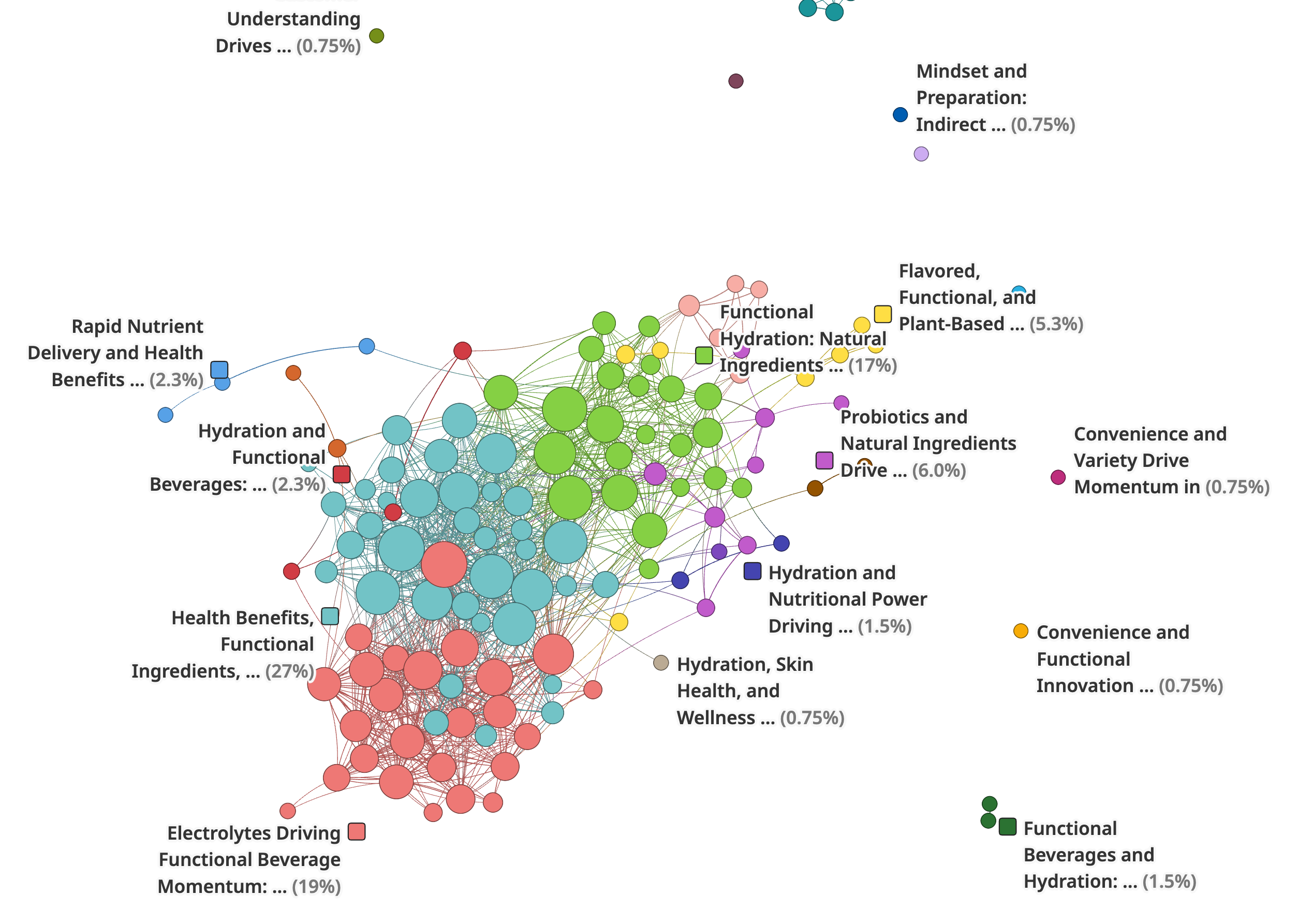

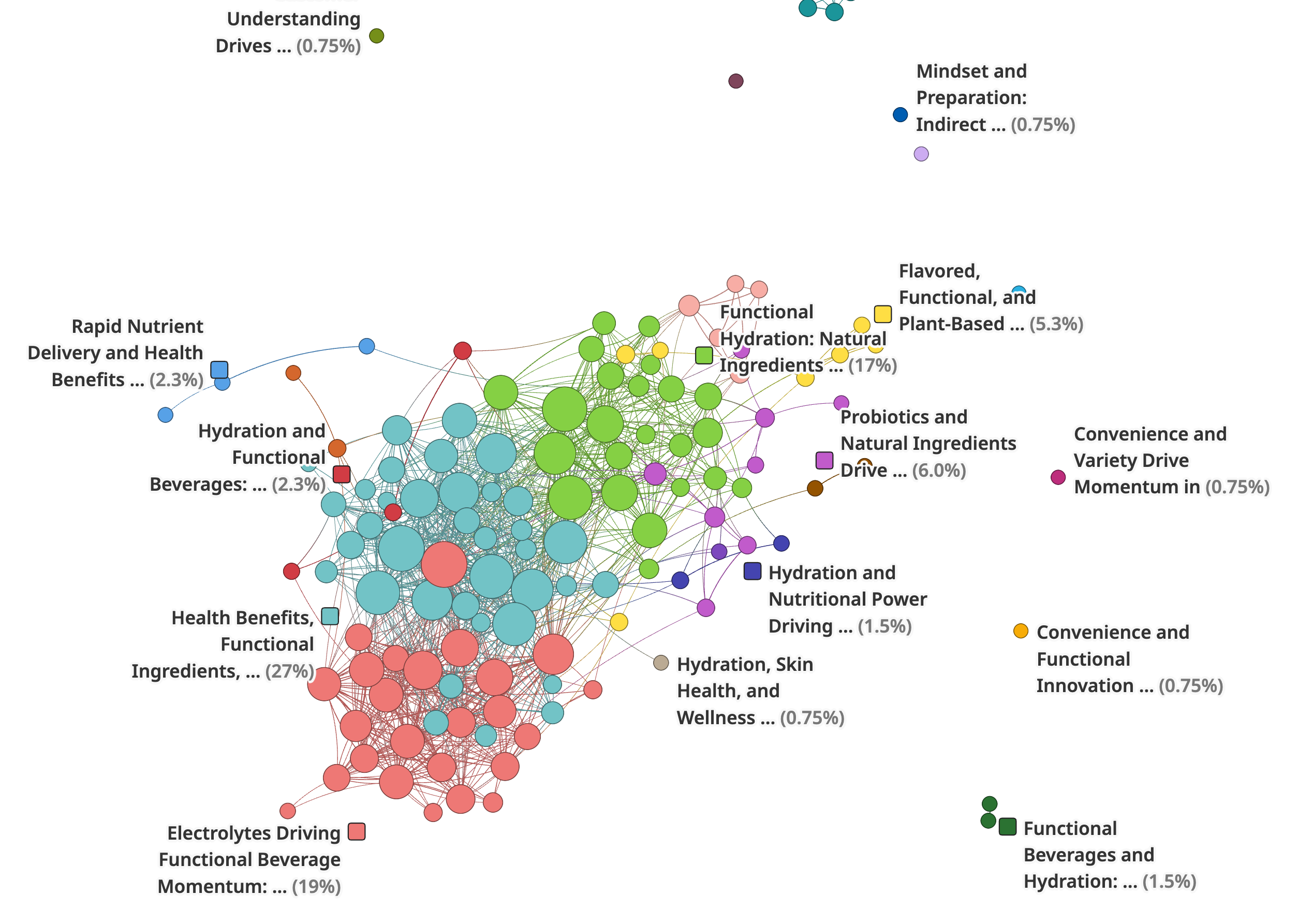

The dataset reveals a strong trend toward functional beverages that offer not only hydration but also added benefits such as electrolytes, vitamins, and natural ingredients and that not only hydrate but also support immunity, energy, and overall wellness.

With key narratives focusing in the following areas:

Health benefits & broad wellness framing

- Conversations frame hydration as a multi-benefit wellness activity—not just thirst-quenching. Users link hydration products to energy, recovery, weight management, skin glow, and immune support; this positions beverages as daily health tools across life stages (athletes, postpartum, chronic conditions). Messaging emphasizes observable outcomes (“my skin is glowing”, “improved energy levels”) which supports trial and advocacy on social channels.

Electrolytes as the technical justification for superior hydration

- Electrolytes are presented as the functional differentiator that justifies buying vs. drinking plain water. Social posts explain basic physiology (electrolyte loss, faster absorption, muscle/cramp prevention) and recommend sugar-free concentrates, powders, and tablets—framing electrolytes as a relatively low-effort, high-perceived-value upgrade. This technical framing appeals both to health-aware consumers and to performance-focused buyers, widening the TAM beyond athletes.

Natural, gut-focused ingredients and clean-label demand

- Consumers favor natural fermented teas, probiotics, ginger, turmeric, amla, and zero-sugar claims; the narrative ties hydration to gut health, immunity, and longer-term wellbeing. Probiotic and kombucha examples show how hydration products double as digestive-support beverages, enhancing perceived functional value. Zero-sugar and anti-artificial-additive claims are recurrent trust signals in posts.

Convenience, formats, and social amplification (why momentum keeps accelerating)

- Momentum is driven by convenient formats (sticks, packets, powders), variety packs, and visually shareable products that perform well on TikTok. Viral deals, hashtags, and product demos shorten the path from awareness to purchase. The combination of portability + social proof creates repeated micro-moments of trial and repurchase.

What Has Influenced This Shift?

When looking at what has driven consumers to enhance their hydration benefits, three areas can be identified:

1. Growth in Wellness and Clean Living Culture

Consumers’ growing commitment to wellness and clean living, emphasising natural, organic, and non-toxic products is driving this shift.

It’s not just about hydration and functional beverages.

It is deeply tied to broader lifestyle choices prioritizing health, immune support, and sustainable consumption.

Consumers are influenced by a holistic approach where hydration is not just about quenching thirst but also about supporting overall physical and mental wellbeing through carefully chosen, clean ingredients and functional benefits.

2. Fitness and Active Lifestyle Culture

Hydration products are strongly influenced by fitness and active lifestyle culture, where consumers seek hydration solutions optimized to enhance performance and recovery.

This culture values functional drinks enriched with electrolytes and nutrients that replenish and re-energize during and after physical activity.

Many posts reference workouts, running, and sports, reflecting how hydration is an integral part of athletic routines and enduranc

3. Digital Health and DIY Trends

Consumers are influenced by the digital health movement and DIY trends that encourage personal experimentation with hydration recipes and natural ingredients.

This culture promotes transparency, empowerment, and a hands-on approach to health, where users share homemade hydration concoctions and ingredient hacks through social media. It reflects a collective curiosity and willingness to engage with wellness beyond commercial products.

This evolving consumption landscape suggests significant opportunities for innovation in the food consumer goods space, specifically in the development of targeted hydration beverages that align with health trends and the modern consumer’s active, on-the-go lifestyle.

How Brands Can Evolve and Capitalize Heading Into 2026

1. When it Comes to the Products, Focus on 3 Key Areas

Natural Ingredients

This consumption driver highlights consumers’ positive response to hydration products made with natural and organic ingredients that offer added health benefits such as vitamins, minerals, and antioxidants.

Consumers feel good about consuming beverages that not only hydrate but also support immunity, energy, and overall wellness.

The preference for natural hydration solutions reflects a demand for clean, non-toxic products free from artificial additives and processed sugars.

The trend toward using ingredients like coconut water, watermelon, lemon, sea salt, and honey indicates that consumers appreciate hydration offerings that align with holistic health and fitness lifestyles.

Convenience

Consumers are motivated by easy-to-use hydration solutions that offer functional benefits such as electrolytes, vitamins, and enhanced energy without added sugars or calories.

- Single-serve hydration packets and powders that promise quick absorption and are compatible with special diets such as keto, vegan, and paleo appeal to on-the-go lifestyles.

- The sugar-free positioning also reassures consumers seeking to avoid unhealthy ingredients commonly found in traditional sports drinks. Convenience coupled with clean nutrition is a key positive driver for repeated consumption and brand loyalty.

Flavor

Product taste and enjoyable sensory experience serve as important drivers for consumers choosing hydration products.

- Posts indicate consumers feel more motivated to stay hydrated when the product offers pleasant, refreshing flavors that make hydration feel less like a chore and more like a treat.

- Flavors inspired by fruits like strawberry, watermelon, lemon, and lime are especially popular, providing a perceived indulgence without compromising health. This positive emotional engagement supports brand preference and sustained consumption behavior.

2. Target the Right Occasions

An obvious place to start is the post-workout and fitness hydration moment:

This is where consumers frequently choose hydration products immediately following physical activity such as workouts, running, or sports.

The occasion is characterized by a functional need for replenishment of electrolytes, energy, and fluids to aid recovery and sustain performance. This moment often occurs at gyms, sports fields, or home shortly after exercise, reflecting an intentional effort to optimize hydration as part of an active lifestyle.

However, for further success these other moments must not be overlooked:

On-the-Go Daily Hydration Occasion

Many consumers use hydration products during their daily routines when they are out and about, such as commuting, traveling, or at work. This occasion addresses the need for convenient, portable hydration solutions that can be consumed quickly to maintain energy and hydration balance throughout a busy day. The functional need is both refreshment and sustained energy, often supported by single-serve packets or low-calorie options.

Morning Wellness Ritual Occasion

Some consumers incorporate hydration beverages into their morning routine at home as part of a wellness ritual. This occasion is motivated by the need to start the day with nourishing, immune-boosting, and energizing hydration that supports overall health and mental clarity. It is often combined with other wellness activities such as juicing, meditation, or light exercise.

Seasonality: Heat and Warm Weather Hydration Occasion

Hydration products are also selected during hot weather or outdoor activities in the warmer seasons to counteract increased fluid loss and heat exhaustion risks. This occasion is typically outdoors, such as during summer outings, hiking, or beach days, where refreshing and cooling hydration options are especially valued to maintain comfort and prevent dehydration.

Social and Relaxation Hydration Occasion

Some posts point to hydration consumption during relaxation moments or social settings, such as sipping flavored hydration drinks while unwinding at home or with friends. This occasion meets an emotional need for enjoyment and indulgence while still prioritizing health-conscious choices. It reflects the fusion of functional hydration with pleasurable flavor experiences in calm or social contexts.

3. Be Mindful of Adoption Frictions and Unmet Needs

Taste and Flavor Authenticity Concerns

Some consumers hesitate to fully adopt hydration products due to concerns about artificial or unpleasant taste profiles. Despite an overall trend toward natural ingredients, negative perceptions around flavor authenticity create friction, especially when products fail to meet expectations for pleasantness without added sugars or artificial sweeteners.

‘I want to like these hydration drinks, but many taste too artificial or bland which makes it hard to drink enough.’ (Posted 2024-06-08) tiktok.com

Sometimes these sugar-free packets taste medicinal or chemical-y, and I end up switching back to plain water.’ (Posted 2024-06-12) tiktok.com

Price Sensitivity and Perceived Value

Price is a significant adoption friction, as some consumers feel commercial hydration solutions are expensive relative to plain water or homemade alternatives. This cost barrier reduces willingness to commit, especially for regular or daily use, where value for money becomes crucial in deciding which hydration product to choose.

‘I love the idea of enhanced hydration powders, but paying so much for single-serve packets isn’t sustainable for my budget.’ (Posted 2024-06-11) tiktok.com

‘Homemade options with coconut water and sea salt are cheaper and seem just as good for hydration—makes me think twice about expensive branded drinks.’ (Posted 2024-06-14) tiktok.com

Confusion Over Ingredient Efficacy and Health Claims

Consumers express uncertainty about the actual benefits and efficacy of ingredients in hydration products. Mixed information and unclear health claims contribute to skepticism and hesitation, with some questioning whether these products deliver on promises around hydration speed, energy, or immune support.

‘Are electrolytes in these drinks really necessary or beneficial for everyday hydration? It’s confusing to know what really works.’ (Posted 2024-06-09) tiktok.com

‘Lots of marketing claims but not enough real info about how these enhance hydration over plain water.’ (Posted 2024-06-13) tiktok.com

Effective Hydration for Diverse Dietary Needs

Some consumers note that available hydration brands do not fully meet the needs of diverse dietary preferences such as ketogenic, paleo, or allergen-free diets. There is demand for products explicitly formulated to support these lifestyles without hidden sugars, synthetic additives, or allergens, providing clearer guidance to help consumers make confident choices.

‘Most hydration powders don’t talk about whether they fit keto or paleo well; it’s hard to find ones I know won’t kick me out of ketosis.’ (Posted 2024-06-10) tiktok.com

‘I want allergen-free hydration options that are clearly labeled so I can avoid reactions.’ (Posted 2024-06-13) tiktok.com

Overall, hydration’s rise in 2025 reflects far more than a fleeting trend—it signals a structural shift in how consumers think about wellbeing, performance, and daily nourishment. With conversations and searches accelerating across platforms, the demand for hydration solutions that deliver functional benefits, clean ingredients, convenience, and enjoyable flavors will only continue to grow.

But with opportunity comes responsibility: brands must address real consumer frictions around taste, clarity of benefits, affordability, and dietary inclusivity to build sustained trust.

As we move into 2026, the brands that win will be those that approach hydration not as a category, but as an ecosystem—one that spans wellness rituals, active lifestyles, daily routines, and seasonal moments. Those able to combine credible functionality with accessible formats, transparent messaging, and authentic value creation will be best positioned to lead in this next era of functional hydration.