Quid Marketing

This blog explores what NRF signals about the state of retail going into 2026. It cuts through the hype to highlight the actual concerns, strategies, and conversations retail leaders are having — showing a shift from reactive tactics to deliberate planning and scalable execution.

Retailers are moving away from crisis-mode and toward strategic, long-term thinking.

AI and analytics have moved from theory to day-to-day execution.

Retail leaders are focused on what’s working operationally: pricing, inventory, in-store experience.

Sentiment is stable — not overly optimistic, but not doomsday either.

NRF has become a checkpoint for aligning strategy and action across the org.

Confidence is returning. Retailers are planning with discipline, not scrambling to react.

Tech is now baked into operations. It’s not just a strategy slide — it’s powering decisions and outcomes.

Execution beats experimentation. Leaders are focused on operational levers they can pull today.

Value matters to consumers. Shopping hasn’t stopped — it’s just more intentional.

Leaders are looking for what’s next, not just what’s new. They’re scaling what works, not chasing shiny objects.

Retailers aren’t asking “What should we try?” — they’re asking “What works, and how do we do more of it?” NRF 2026 signals a return to grounded, data-informed strategy with an emphasis on execution. The winners will be those who act decisively on insights, not just talk about them.

Retail enters 2026 after several years of sustained pressure. Inflation cycles. Supply chain instability. Rapid technology adoption. Shifts in how consumers shop, plan, and spend.

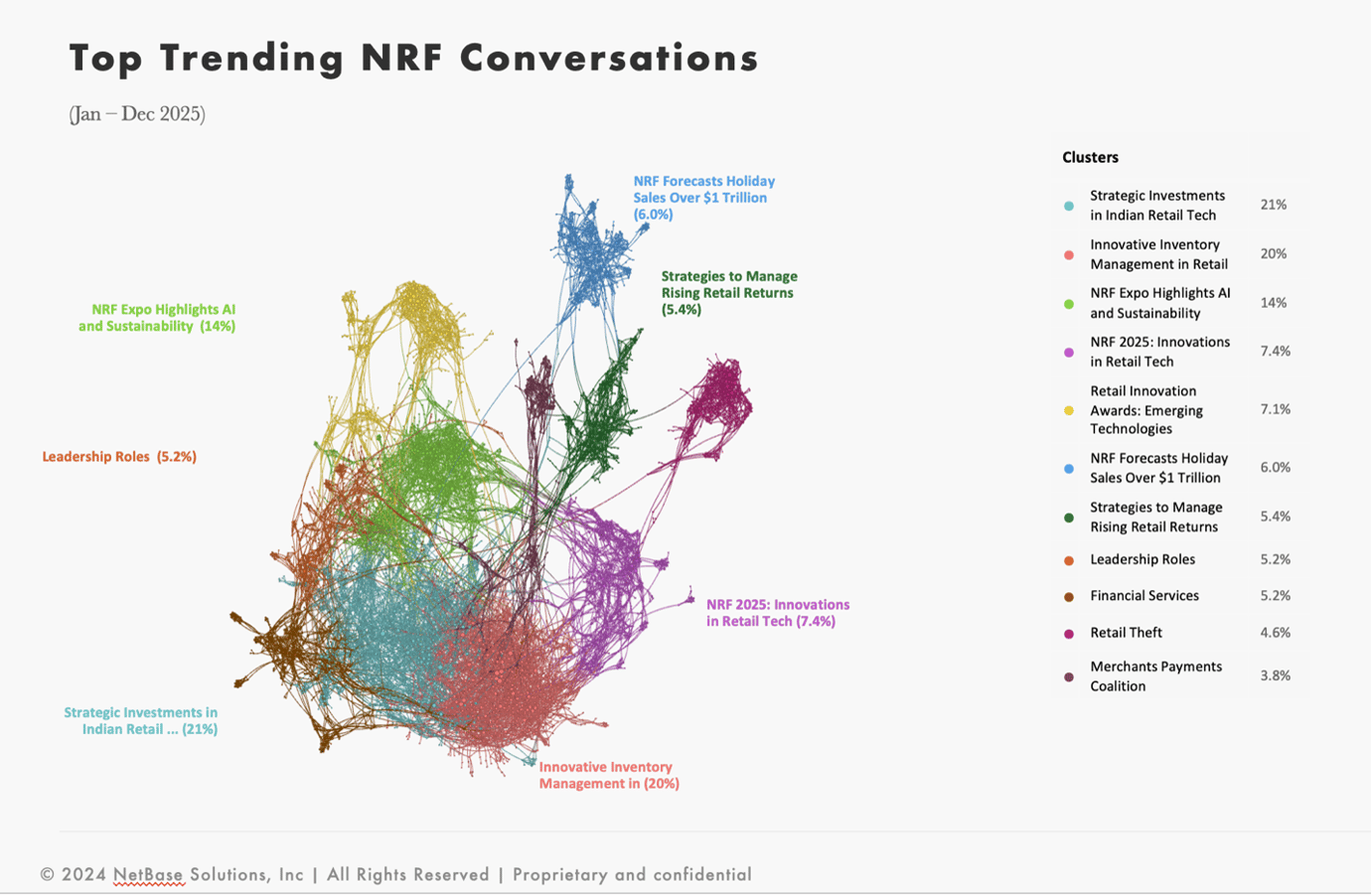

NRF brings those forces into focus. At a high level, the overarching NRF visual sets the frame for how retail leaders are thinking about the year ahead. It reflects a market that is no longer reacting to disruption in isolation, but instead aligning technology, operations, and leadership around execution.

The retail sector is undergoing a significant transformation driven by technological innovations and shifting consumer behaviors. Key themes include the adoption of advanced technologies to enhance operational efficiency, the strategic management of evolving consumer preferences, and tackling economic and operational challenges. Retailers are also focusing on sustainability and ethical practices to meet consumer expectations and ensure environmental responsibility. Here's a breakdown:

Technological Innovations in Retail: The integration of technologies like AI, IoT, and automated systems is reshaping retail, enhancing operational efficiency and improving customer experiences. This theme covers the adoption and impact of these technologies across various retail operations.

Consumer Behavior and Market Trends: This theme addresses the shifting consumer preferences towards online shopping, sustainability, and personalized experiences, influenced by technological advancements and economic factors.

Challenges in Retail Operations: Retailers are facing challenges such as inventory management, theft, and adapting to new consumer behaviors, with economic pressures necessitating efficient returns management and innovative solutions.

Economic Impact and Market Dynamics: Focuses on how economic variables like inflation and consumer spending power affect retail growth and market dynamics, with insights into retail sales trends and projections.

Sustainability and Ethical Practices: Increasing commitment to sustainability and ethical practices in retail, aiming to reduce environmental impact and enhance consumer trust through sustainable and ethical operations.

With that context in place, the late-2025 NRF dataset allows us to zoom in. Rather than relying on opinion or prediction, it organizes retail conversation into measurable signals across sentiment, attributes, behaviors, and themes.

Read together, these visuals show an industry that has moved past reaction and into recalibration.

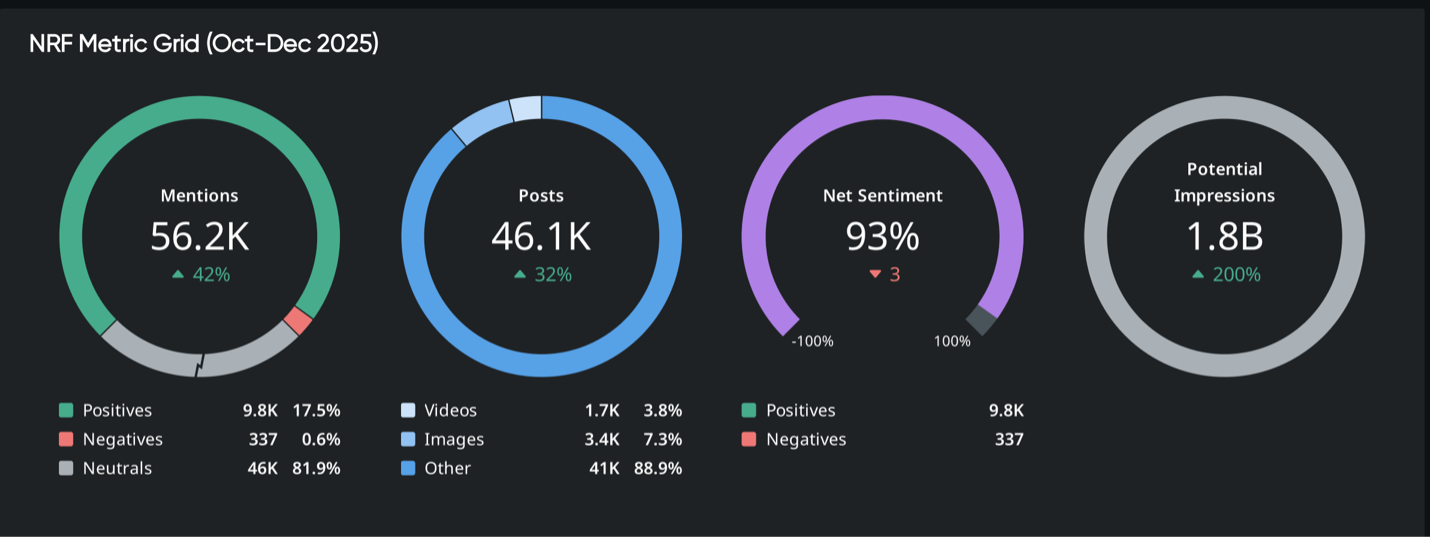

The NRF Metric Grid provides a high-level snapshot of how retail conversation is behaving.

High conversation volume

Overwhelmingly neutral tone

Strong positive sentiment

Very limited negative activity

Retail discussions are neither panicked, nor showing exaggerated optimism.

Retailers and industry observers conversation reflects evaluation, adjustment, and forward-looking decision-making rather than reaction to shocks.

Conversation Attributes show what is driving the discussion.

The most prominent attributes include:

Driving global retail innovation

Omnichannel retail technology

Real-time shopper analytics

In-store digital experience

Dynamic pricing

Expectations of robust holiday sales

These attributes point to a retail environment focused on execution. Innovation appears, but it is tied directly to operations. Digital tools are framed around visibility, pricing, and in-store engagement rather than abstract transformation.

Retail attention is settling around tools and capabilities that support daily decisions, and conversation emphasizes how retail functions, not just what it aspires to become.

Emotions capture how retail conversation sounds emotionally.

Positive emotional language dominates:

Excitement

Successful

Thrilled

Happy

Bullish

At the same time, caution remains present:

Concern

Inflation

Uncertainty

Frustration

Retail sentiment reflects confidence and awareness. Retailers and observers acknowledge economic pressure without letting it dominate the narrative. Optimism exists, but it is measured.

This emotional balance often appears when industries feel capable of managing complexity rather than being overwhelmed by it.

Behaviors point to action, not attitude.

Key behaviors include:

Adopting features

Scaling operations

Introducing new capabilities

Organizing and planning

Designing retail experiences

Selecting technology partners

These verbs describe movement, not hesitation. Retailers are implementing, adjusting and scaling rather than waiting.

Behavioral language suggests momentum. Retailers are acting within constraints, not delaying decisions until conditions improve.

The topics consumers raise in retail discussions translate abstract trends into tangible focus areas for future-facing brands.

Frequently referenced items include:

Retail technology platforms

AI-driven retail technology

Omnichannel retail strategies

Real-time analytics

In-store engagement

These are operational components of modern retail environments.

Retail attention is centered on systems and capabilities that directly influence performance. The conversation favors infrastructure over experimentation.

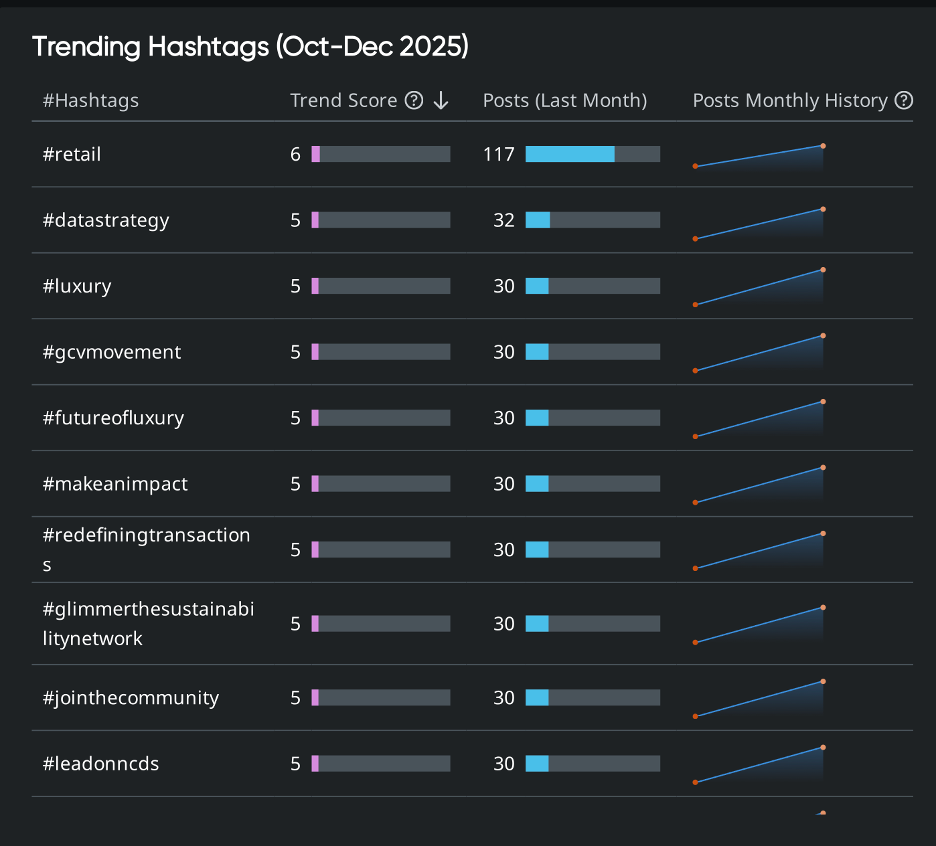

Trending hashtags reveal how retail conversation is clustering socially.

Common themes include:

Retail

Data strategy

Luxury

Future-focused retail conversations

Community and leadership signals

Hashtags indicate how conversation travels. These themes suggest retail discussions are spreading through professional, strategic, and leadership-oriented channels rather than consumer hype cycles.

Across all visuals, technology appears repeatedly, but always tied to use.

AI, analytics, and omnichannel tools are discussed as part of retail’s operating model. They support pricing, inventory decisions, customer engagement, and planning cycles.

Technology is shown as embedded infrastructure rather than a standalone trend.

When viewed together, the NRF visuals tell a consistent story.

Retail is emotionally steady and focused on infrastructure. It is managing economic pressure without retreat and aligning around execution rather than experimentation.

2026 consumers will reward retailers that integrate tools well, read consumer signals accurately and plan within constraint.

Key Takeaways

Retail sentiment remains stable and constructive

Technology is embedded in everyday retail operations

Consumers continue to engage, with value and planning in mind

Supply chain and economic pressure remain part of strategy

NRF acts as a directional reference point for retail leadership

Retail is not standing still. It is tightening its focus and preparing deliberately for what comes next.

Quid helps retail and consumer brands translate signals like these into clear strategy, planning and action. Connect with our team to understand what these NRF trends mean for your business.